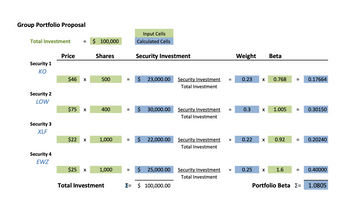

Group Portfolio Proposal Total Investment Security 1 ΚΟ Security 2 LOW Security 3 XLF Security 4 EWZ Price $46 X $75 X $22 X $25 X $ 100,000 Shares 500 400 1,000 1,000 Total Investment = = Input Cells Calculated Cells Security Investment = $ 23,000.00 $ 30,000.00 = $ 22,000.00 $ 25,000.00 = $ 100,000.00 Security Investment Total Investment Security Investment = Total Investment Security Investment Total Investment = Security Investment Total Investment = Weight Beta 0.23 X 0.768 0.3 X 1.005 0.22 X 0.92 0.25 X 1.6 = 0.17664 || = 0.30150 = 0.20240 = 0.40000 Portfolio Beta [= 1.0805

Group Portfolio Proposal Total Investment Security 1 ΚΟ Security 2 LOW Security 3 XLF Security 4 EWZ Price $46 X $75 X $22 X $25 X $ 100,000 Shares 500 400 1,000 1,000 Total Investment = = Input Cells Calculated Cells Security Investment = $ 23,000.00 $ 30,000.00 = $ 22,000.00 $ 25,000.00 = $ 100,000.00 Security Investment Total Investment Security Investment = Total Investment Security Investment Total Investment = Security Investment Total Investment = Weight Beta 0.23 X 0.768 0.3 X 1.005 0.22 X 0.92 0.25 X 1.6 = 0.17664 || = 0.30150 = 0.20240 = 0.40000 Portfolio Beta [= 1.0805

Oh no! Our experts couldn't answer your question.

Don't worry! We won't leave you hanging. Plus, we're giving you back one question for the inconvenience.

Submit your question and receive a step-by-step explanation from our experts in as fast as 30 minutes.

You have no more questions left.

Message from our expert:

Your question requires hands-on experimentation or research-driven output, which exceeds the capabilities of our service. A question credit has been added to your account for future use.

Your Question:

Can someone make me a chart like this but replace the values in the chart using AAPL, MSFT, INTC, and GOOG? I need help finding the info, thank you!

Transcribed Image Text:Group Portfolio Proposal

Total Investment

Security 1

ΚΟ

Security 2

LOW

Security 3

XLF

Security 4

EWZ

Price

$46 X

$75 X

$22 X

$25 X

$ 100,000

Shares

500

400

1,000

1,000

Total Investment

=

=

Input Cells

Calculated Cells

Security Investment

=

$ 23,000.00

$ 30,000.00

= $ 22,000.00

$ 25,000.00

= $ 100,000.00

Security Investment

Total Investment

Security Investment =

Total Investment

Security Investment

Total Investment

=

Security Investment

Total Investment

=

Weight

Beta

0.23 X 0.768

0.3 X 1.005

0.22 X 0.92

0.25 X 1.6

= 0.17664

||

=

0.30150

= 0.20240

= 0.40000

Portfolio Beta [=

1.0805

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you