GIVEN THE FOLLOWING QD=240-5P QS=P WHERE QD IS THE QUANTITY DEMANDED, QS IS THE QUANTITY SUPPLIED AND P IS THE PRICE. SUPPOSE THAT THE GOVERNMENT DECIDES TO IMPOSE A TAX OF $12 PER UNIT ON SELLERS IN THIS MARKET DETERMINE TOTAL SURPLUS AFTER TAX GIVEN THE FOLLOWING QD=240-5P QS=P WHERE QD IS THE QUANTITY DEMANDED, QS IS THE QUANTITY SUPPLIED AND P IS THE PRICE. SUPPOSE THAT THE GOVERNMENT DECIDES TO IMPOSE A TAX OF $12 PER UNIT ON SELLERS IN THIS MARKET DETERMINE DEAD WEIGHT LOSS OF THE TAX GIVEN THE FOLLOWING QD=240-5P QS=P WHERE QD IS THE QUANTITY DEMANDED, QS IS THE QUANTITY SUPPLIED AND P IS THE PRICE. SUPPOSE THAT THE GOVERNMENT DECIDES TO IMPOSE A TAX OF $12 PER UNIT ON SELLERS IN THIS MARKET DETERMINE: TAX REVENUE

GIVEN THE FOLLOWING

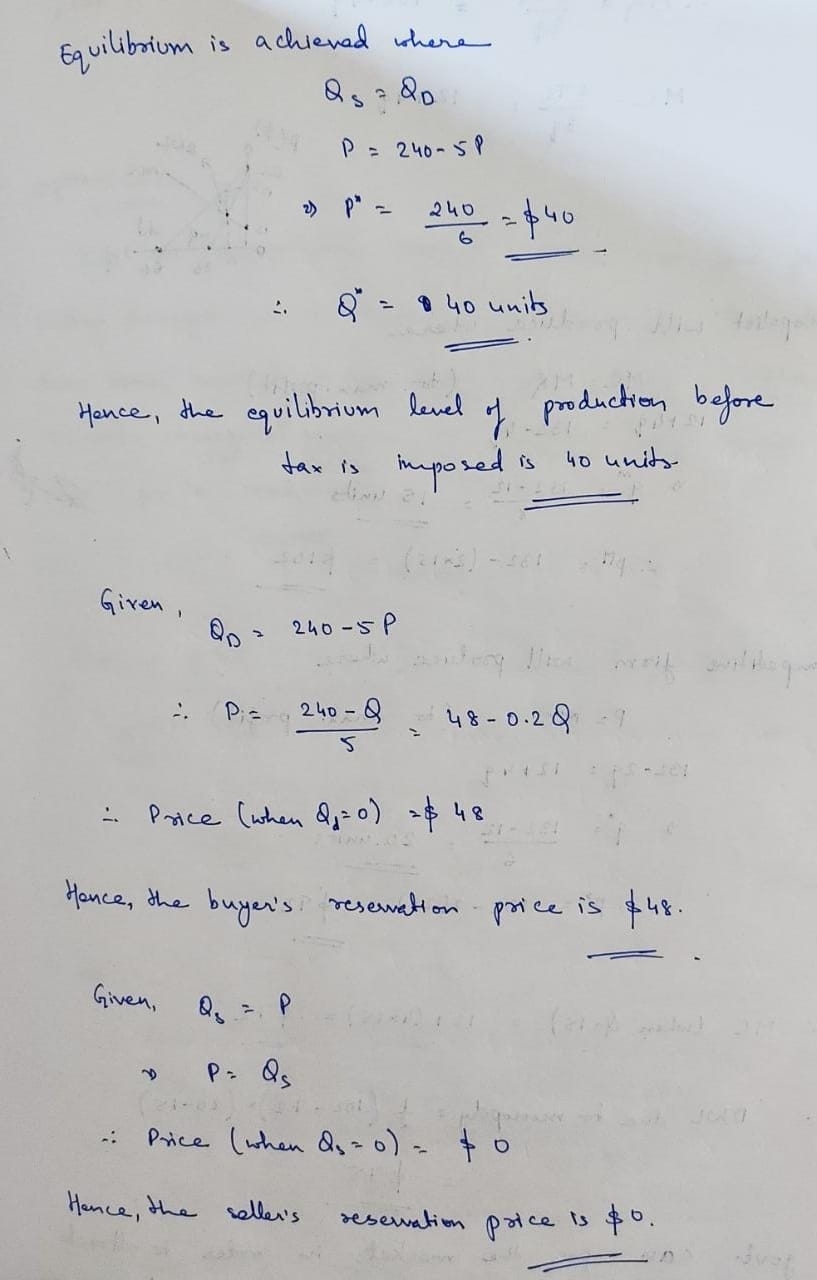

QD=240-5P

QS=P

WHERE QD IS THE QUANTITY DEMANDED, QS IS THE QUANTITY SUPPLIED AND P IS THE

SUPPOSE THAT THE GOVERNMENT DECIDES TO IMPOSE A TAX OF $12 PER UNIT ON SELLERS IN THIS MARKET DETERMINE

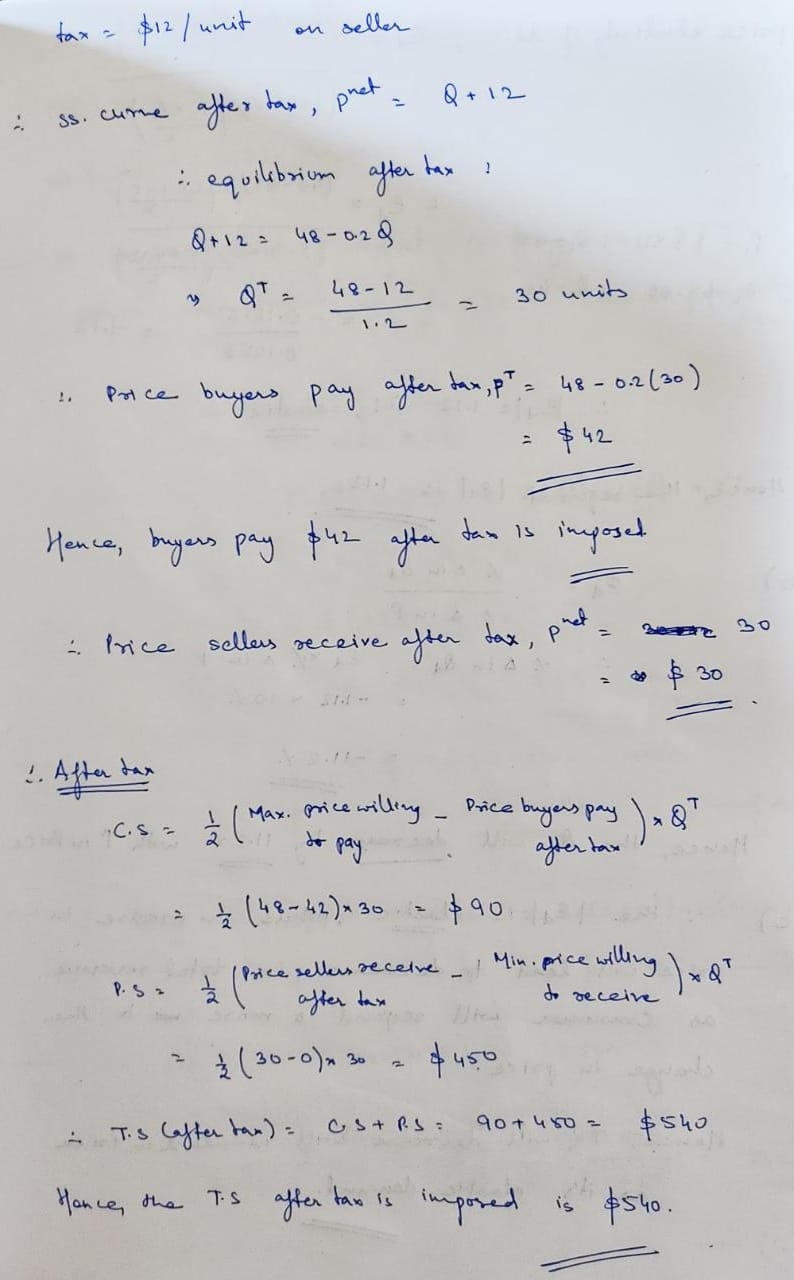

TOTAL SURPLUS AFTER TAX

GIVEN THE FOLLOWING

QD=240-5P

QS=P

WHERE QD IS THE QUANTITY DEMANDED, QS IS THE QUANTITY SUPPLIED AND P IS THE PRICE.

SUPPOSE THAT THE GOVERNMENT DECIDES TO IMPOSE A TAX OF $12 PER UNIT ON SELLERS IN THIS MARKET DETERMINE

DEAD WEIGHT LOSS OF THE TAX

GIVEN THE FOLLOWING

QD=240-5P

QS=P

WHERE QD IS THE QUANTITY DEMANDED, QS IS THE QUANTITY SUPPLIED AND P IS THE PRICE.

SUPPOSE THAT THE GOVERNMENT DECIDES TO IMPOSE A TAX OF $12 PER UNIT ON SELLERS IN THIS MARKET DETERMINE:

TAX REVENUE

After the imposition of tax the consumer surplus declines as price paid by consumer increases moreover producer surplus too declines as price received by seller decreases due to thr imposition of tax.

Step by step

Solved in 5 steps with 4 images