Given the following information: QD = 240 – 5P QS = P Where QD is the quantity demanded, Qs is the quantity supplied and P is the price Suppose that the government decides to impose a tax of $12 per unit on sellers in this market. Determine demand the seller’s price after tax. Given the following information: QD = 240 – 5P QS = P Where QD is the quantity demanded, Qs is the quantity supplied and P is the price Suppose that the government decides to impose a tax of $12 per unit on sellers in this market. Determine the quantity after tax

Given the following information:

QD = 240 – 5P

QS = P

Where QD is the quantity demanded, Qs is the quantity supplied and P is the

Suppose that the government decides to impose a tax of $12 per unit on sellers in this market. Determine

Given the following information:

QD = 240 – 5P

QS = P

Where QD is the quantity demanded, Qs is the quantity supplied and P is the price

Suppose that the government decides to impose a tax of $12 per unit on sellers in this market. Determine the quantity after tax

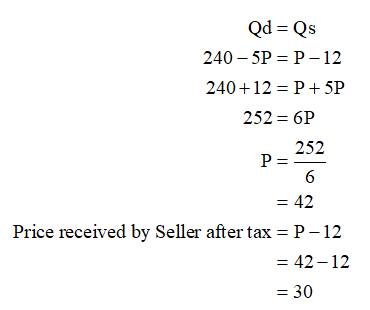

The demand and supply are given and the tax rate charged on the sellers is given to be $12. Thus, the new supply curve will be Qs = P-12 in which P is the price paid by the consumers and P-12 is the price received by the sellers. Thus, the buyer’s price can be calculated at the equilibrium as follows:

Thus, the seller’s price after tax is $30.

Step by step

Solved in 2 steps with 1 images