geted al o ctec ctec rear, s pr ct m et la ct la emb ishir nine emb ishir - dep

Chapter1: Financial Statements And Business Decisions

Section: Chapter Questions

Problem 1Q

Related questions

Question

Transcribed Image Text:Stewart Company, a recent entrant to the market, manufacturers a popular robotic toy. There are

two production departments-Assembly and Finishing. Selected budgeted and actual data are

below.

Assembly

$276,000

$343,200

80,000

1,300

Budgeted overhead

Finishing

$288,000

Actual overhead

$198,000

Expected direct labor hours

Expected machine hours

24,960

120,000

During the year, 10,000 units of the toy were produced and 9,700 units were sold. Actual data

related to this production are below.

Direct materials cost

$540,012

$48,600

Direct labor cost

Direct labor hours used:

Assembly

Finishing

Machine hours used:

82,560

26,880

Assembly

Finishing

1,680

130,940

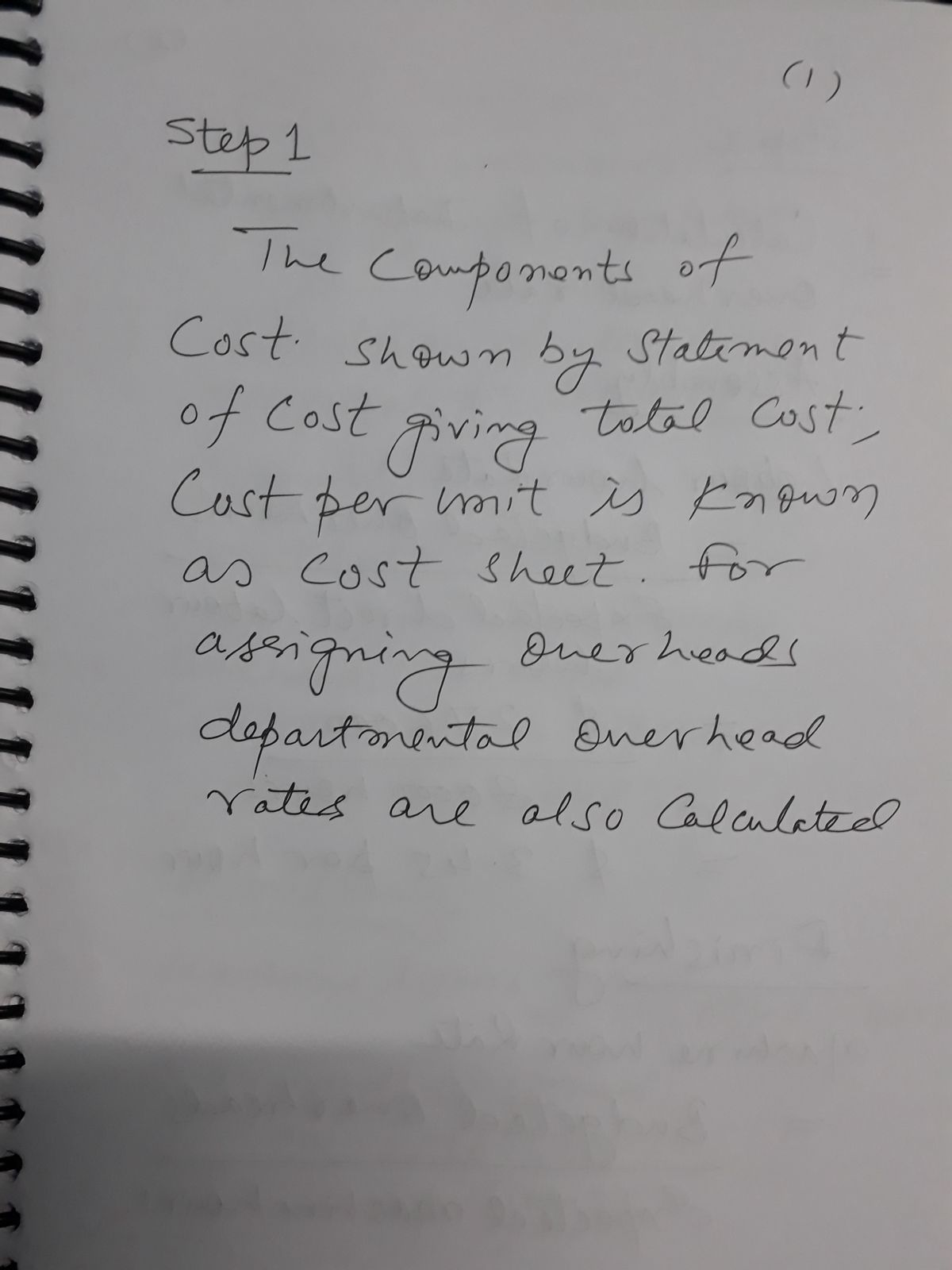

Stewart uses departmental overhead rates-Assembly is based on direct labor hours and

Finishing is based on machine hours.

If necessary, round final answers to 2 decimal places.

Required:

1. Compute the departmental overhead rates for a) Assembly and b) Finishing.

2. Using the departmental rates, compute the overhead costs assigned to production?

3. For Finishing only, compute the overhead variance and label it as under- or overapplied.

4. Compute the per-unit manufacturing costs for the production (assuming normal costing).

Expert Solution

Step 1

Trending now

This is a popular solution!

Step by step

Solved in 5 steps with 5 images

Recommended textbooks for you

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis…

Accounting

ISBN:

9780134475585

Author:

Srikant M. Datar, Madhav V. Rajan

Publisher:

PEARSON

Intermediate Accounting

Accounting

ISBN:

9781259722660

Author:

J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:

McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:

9781259726705

Author:

John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:

McGraw-Hill Education