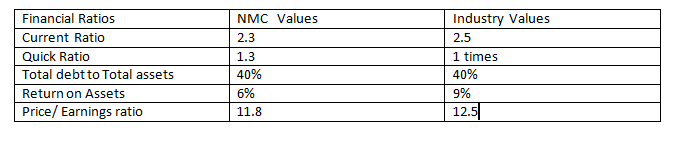

Financial Ratios Current Ratio Quick (Acid) Ratio Total Debt to Total Assets Return on Assets (ROA) Price/Earnings Ratio Industry Values 2.5 times 1.0 times 40% 6% 12.5 times NMC Values 2.3 1.3 40% 9% 11.8

Financial Ratios Current Ratio Quick (Acid) Ratio Total Debt to Total Assets Return on Assets (ROA) Price/Earnings Ratio Industry Values 2.5 times 1.0 times 40% 6% 12.5 times NMC Values 2.3 1.3 40% 9% 11.8

Chapter1: Financial Statements And Business Decisions

Section: Chapter Questions

Problem 1Q

Related questions

Question

What should NMC do to improve its position in the market?

Transcribed Image Text:Thousands of dollars (except stock

NMC Corporation Income Statement

for the Calendar Year (January 1-

December 31)

NMC Corporation Balance

Sheet (Average of beginning (thousands of

and end of year)

Assets

Liabilities and Equity

price, earnings per share, and

dividends per share)

(thousands of dollars)

dollars)

Net sales

Cost and expenses:

EBIT

Less interest expense:

$3,000

$2,734

$266

$50 Accounts payable

soNotes payable

$350 Accrued Wages

Cash

$60

Market securities

$100

$10

$130

Accounts receivable

$66

Inventories

Total Current Assets:

$300 Accrued Taxes

S700 Total Current Liabilities:

$1,300 Total Long Term Debt:

$300

$800

Earnings before taxes

$200

Taxes

80

Net plant and equipment:

Net income before preferred dividends

$120

Total Stock Holder's Equity:

$900

Dividends to preferred stockholders

S8

Total Assets:

$2,000 Total liabilities and equity:

$2,000|

Net income available to common stock

S112

holders

NMC Values

2.3

1.3

Industry Values

2.5 times

Per share common stock:

Financial Ratios

Stock Price

Earnings per share

Dividends per share

$26.50

Current Ratio

Quick (Acid) Ratio

Total Debt to Total Assets

S2.24

1.0 times

$1.84

40%

40%

Return on Assets (ROA)

Price/Earnings Ratio

6%

12.5 times

9%

11.8

CR= Current Assets/CurrentLiabilities

QR= Current Assets - Inventory/CurrentLiabilities

DA= Total Debt/Total Assets

NIAT = Earnings before taxes - taxes

ROA= NIAT/Assets

NMC should

To improve its position in the market.

EPS= NIAT/number of shares common stock

P/E= Market Price/EPS

Expert Solution

Step 1

The market Position of a company is measured by its ability to pay its current as well its long term debts and also when the earnings of the shareholders increase with the passage of time.

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis…

Accounting

ISBN:

9780134475585

Author:

Srikant M. Datar, Madhav V. Rajan

Publisher:

PEARSON

Intermediate Accounting

Accounting

ISBN:

9781259722660

Author:

J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:

McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:

9781259726705

Author:

John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:

McGraw-Hill Education