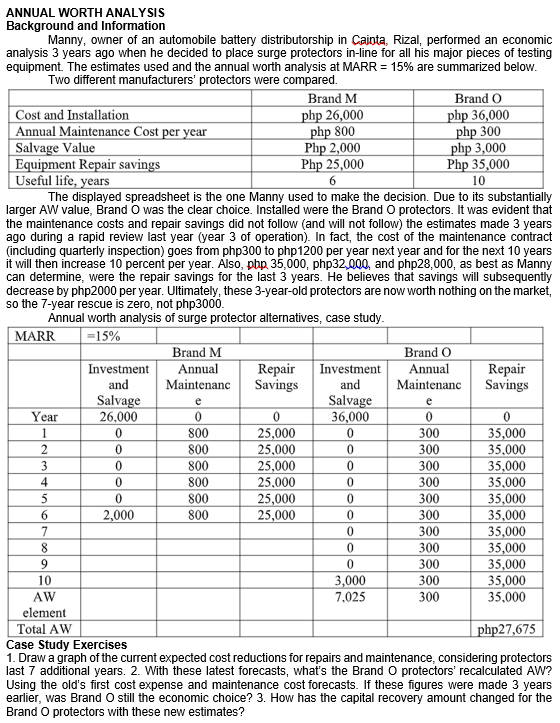

ANNUAL WORTH ANALYSIS Background and Information Manny, owner of an automobile battery distributorship in Cainta, Rizal, performed an economic analysis 3 years ago when he decided to place surge protectors in-line for all his major pieces of testing equipment. The estimates used and the annual worth analysis at MARR = 15% are summarized below. Two different manufacturers' protectors were compared. Brand M php 26,000 php 800 Php 2,000 Php 25,000 Brand O Cost and Installation Annual Maintenance Cost per year Salvage Value Equipment Repair savings Useful life, years The displayed spreadsheet is the one Manny used to make the decision. Due to its substantially larger AW value, Brand O was the clear choice. Installed were the Brand O protectors. It was evident that the maintenance costs and repair savings did not follow (and will not follow) the estimates made 3 years ago during a rapid review last year (year 3 of operation). In fact, the cost of the maintenance contract (including quarterly inspection) goes from php300 to php1200 per year next year and for the next 10 years it will then increase 10 percent per year. Also, php. 35,000, php32,000, and php28,000, as best as Manny can determine, were the repair savings for the last 3 years. He believes that savings will subsequently decrease by php2000 per year. Ultimately, these 3-year-old protectors are now worth nothing on the market, so the 7-year rescue is zero, not php3000. php 36,000 php 300 php 3,000 Php 35,000 6 10 Annual worth analysis of surge protector alternatives, case study. | MARR =15% Brand M Brand O Repair Savings Repair Savings Investment and Salvage 26,000 Annual Maintenanc Investment and Annual Maintenanc Salvage 36,000 e e Year 800 25,000 25,000 300 35,000 35.000 800 800 300 300 3 25,000 35,000 35,000 35,000 35,000 35,000 35,000 35,000 35,000 25.000 25,000 25,000 4 800 800 300 5 300 2,000 800 300 7 300 300 300 300 300 10 3,000 7,025 AW 35,000 element Total AW Case Study Exercises 1. Draw a graph of the current expected cost reductions for repairs and maintenance, considering protectors last 7 additional years. 2. With these latest forecasts, what's the Brand O protectors' recalculated AW? Using the old's first cost expense and maintenance cost forecasts. If these figures were made 3 years earlier, was Brand O still the economic choice? 3. How has the capital recovery amount changed for the Brand O protectors with these new estimates? php27,675

ANNUAL WORTH ANALYSIS Background and Information Manny, owner of an automobile battery distributorship in Cainta, Rizal, performed an economic analysis 3 years ago when he decided to place surge protectors in-line for all his major pieces of testing equipment. The estimates used and the annual worth analysis at MARR = 15% are summarized below. Two different manufacturers' protectors were compared. Brand M php 26,000 php 800 Php 2,000 Php 25,000 Brand O Cost and Installation Annual Maintenance Cost per year Salvage Value Equipment Repair savings Useful life, years The displayed spreadsheet is the one Manny used to make the decision. Due to its substantially larger AW value, Brand O was the clear choice. Installed were the Brand O protectors. It was evident that the maintenance costs and repair savings did not follow (and will not follow) the estimates made 3 years ago during a rapid review last year (year 3 of operation). In fact, the cost of the maintenance contract (including quarterly inspection) goes from php300 to php1200 per year next year and for the next 10 years it will then increase 10 percent per year. Also, php. 35,000, php32,000, and php28,000, as best as Manny can determine, were the repair savings for the last 3 years. He believes that savings will subsequently decrease by php2000 per year. Ultimately, these 3-year-old protectors are now worth nothing on the market, so the 7-year rescue is zero, not php3000. php 36,000 php 300 php 3,000 Php 35,000 6 10 Annual worth analysis of surge protector alternatives, case study. | MARR =15% Brand M Brand O Repair Savings Repair Savings Investment and Salvage 26,000 Annual Maintenanc Investment and Annual Maintenanc Salvage 36,000 e e Year 800 25,000 25,000 300 35,000 35.000 800 800 300 300 3 25,000 35,000 35,000 35,000 35,000 35,000 35,000 35,000 35,000 25.000 25,000 25,000 4 800 800 300 5 300 2,000 800 300 7 300 300 300 300 300 10 3,000 7,025 AW 35,000 element Total AW Case Study Exercises 1. Draw a graph of the current expected cost reductions for repairs and maintenance, considering protectors last 7 additional years. 2. With these latest forecasts, what's the Brand O protectors' recalculated AW? Using the old's first cost expense and maintenance cost forecasts. If these figures were made 3 years earlier, was Brand O still the economic choice? 3. How has the capital recovery amount changed for the Brand O protectors with these new estimates? php27,675

Chapter1: Making Economics Decisions

Section: Chapter Questions

Problem 1QTC

Related questions

Question

Transcribed Image Text:ANNUAL WORTH ANALYSIS

Background and Information

Manny, owner of an automobile battery distributorship in Cainta, Rizal, performed an economic

analysis 3 years ago when he decided to place surge protectors in-line for all his major pieces of testing

equipment. The estimates used and the annual worth analysis at MARR = 15% are summarized below.

Two different manufacturers' protectors were compared.

Brand M

php 26,000

php 800

Php 2,000

Php 25,000

Brand O

Cost and Installation

Annual Maintenance Cost per year

Salvage Value

Equipment Repair savings

Useful life, years

The displayed spreadsheet is the one Manny used to make the decision. Due to its substantially

larger AW value, Brand O was the clear choice. Installed were the Brand O protectors. It was evident that

the maintenance costs and repair savings did not follow (and will not follow) the estimates made 3 years

ago during a rapid review last year (year 3 of operation). In fact, the cost of the maintenance contract

(including quarterly inspection) goes from php300 to php1200 per year next year and for the next 10 years

it will then increase 10 percent per year. Also, php. 35,000, php32,000, and php28,000, as best as Manny

can determine, were the repair savings for the last 3 years. He believes that savings will subsequently

decrease by php2000 per year. Ultimately, these 3-year-old protectors are now worth nothing on the market,

so the 7-year rescue is zero, not php3000.

php 36,000

php 300

php 3,000

Php 35,000

6

10

Annual worth analysis of surge protector alternatives, case study.

| MARR

=15%

Brand M

Brand O

Repair

Savings

Repair

Savings

Investment

and

Salvage

26,000

Annual

Maintenanc

Investment

and

Annual

Maintenanc

Salvage

36,000

e

e

Year

800

25,000

25,000

300

35,000

35.000

800

800

300

300

3

25,000

35,000

35,000

35,000

35,000

35,000

35,000

35,000

35,000

25.000

25,000

25,000

4

800

800

300

5

300

2,000

800

300

7

300

300

300

300

300

10

3,000

7,025

AW

35,000

element

Total AW

Case Study Exercises

1. Draw a graph of the current expected cost reductions for repairs and maintenance, considering protectors

last 7 additional years. 2. With these latest forecasts, what's the Brand O protectors' recalculated AW?

Using the old's first cost expense and maintenance cost forecasts. If these figures were made 3 years

earlier, was Brand O still the economic choice? 3. How has the capital recovery amount changed for the

Brand O protectors with these new estimates?

php27,675

Expert Solution

Step 1

Given:

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Economics (12th Edition)

Economics

ISBN:

9780134078779

Author:

Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:

PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:

9780134870069

Author:

William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:

PEARSON

Principles of Economics (12th Edition)

Economics

ISBN:

9780134078779

Author:

Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:

PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:

9780134870069

Author:

William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:

PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:

9781305585126

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:

9781337106665

Author:

Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:

Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-…

Economics

ISBN:

9781259290619

Author:

Michael Baye, Jeff Prince

Publisher:

McGraw-Hill Education