Espresso Ltd. is an investment management firm that had, at the beginning of the current year on January 1, 2021, a balance of $127,000 in its Trading Investments account (using the fair value through profit or loss model) and a balance of $526,000 in its Investment in Associates account (using the equity method). At the end of the year, these account balances were $139,000 and $637,000, respectively. During the year, dividends of $54,000 were received from associates while $11,000 was received from tra investments. In addition, the company purchased investments in associates and trading investments for cash of $129,000 and $52,000, respectively. Also, during 2021, the company received $42,000 when it sold trading investments that it carried at $30,00

Espresso Ltd. is an investment management firm that had, at the beginning of the current year on January 1, 2021, a balance of $127,000 in its Trading Investments account (using the fair value through profit or loss model) and a balance of $526,000 in its Investment in Associates account (using the equity method). At the end of the year, these account balances were $139,000 and $637,000, respectively. During the year, dividends of $54,000 were received from associates while $11,000 was received from tra investments. In addition, the company purchased investments in associates and trading investments for cash of $129,000 and $52,000, respectively. Also, during 2021, the company received $42,000 when it sold trading investments that it carried at $30,00

Chapter1: Financial Statements And Business Decisions

Section: Chapter Questions

Problem 1Q

Related questions

Question

Hello,

How do I fill in the Statement of Income for this question?

Thanks

Transcribed Image Text:Espresso Ltd. is an investment management firm that had, at the beginning of the current year on January 1, 2021, a balance of

$127,000 in its Trading Investments account (using the fair value through profit or loss model) and a balance of $526,000 in its

Investment in Associates account (using the equity method). At the end of the year, these account balances were $139,000 and

$637,000, respectively. During the year, dividends of $54,000 were received from associates while $11,000 was received from trading

investments. In addition, the company purchased investments in associates and trading investments for cash of $129,000 and

$52,000, respectively. Also, during 2021, the company received $42,000 when it sold trading investments that it carried at $30,000.

Transcribed Image Text:List the accounts that Espresso will show on its 2021 statement of income pertaining to its investments. Indicate where these

accounts will appear on the statement of income. (Enter loss using either a negative sign preceding the number e.g. -2,945 or

parentheses e.g. (2,945).)

EspressoLtd.

Statement of Income

$

tA

tA

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

Hello, this is the next part of this question but I'm confused on how to solve it

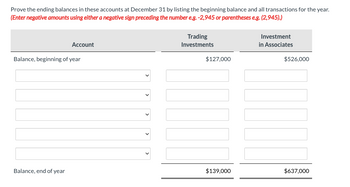

Transcribed Image Text:Prove the ending balances in these accounts at December 31 by listing the beginning balance and all transactions for the year.

(Enter negative amounts using either a negative sign preceding the number e.g. -2,945 or parentheses e.g. (2,945).)

Account

Balance, beginning of year

Balance, end of year

<

<

Trading

Investments

$127,000

$139,000

Investment

in Associates

$526,000

$637,000

Solution

Recommended textbooks for you

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis…

Accounting

ISBN:

9780134475585

Author:

Srikant M. Datar, Madhav V. Rajan

Publisher:

PEARSON

Intermediate Accounting

Accounting

ISBN:

9781259722660

Author:

J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:

McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:

9781259726705

Author:

John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:

McGraw-Hill Education