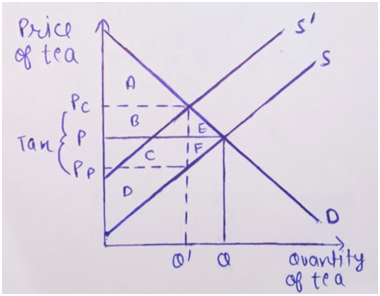

Suppose the equilibrium price of tea is P and quantity is Q where the demand curve of tea (D) intersects supply curve of tea (S). At this price and quantity, the consumers surplus is the area A+B +E above price P and below demand curve of tea and the producers, the surplus is the area C+D+F below price P and above supply curve of tea.

If the excise tax is levied on the sellers of the tea, the supply of tea decreases and the supply curve of tea shifts to left from S to S’. This will increase the price from P to Pc and decrease the quantity from Q to Q’ at the intersection of D and S’. But the Pc is the price which consumer pays for tea. The producer will get only price Pp as the producers also need to pay the excise tax equal to Pc-Pp.

Now the consumer surplus will decrease to area A as the price paid by buyer increases from P to Pc and the producer surplus will decrease to area D as the price received b producer decreases from Pc to Pp. So, both sellers and buyers will be worse off.

Step by step

Solved in 2 steps with 1 images