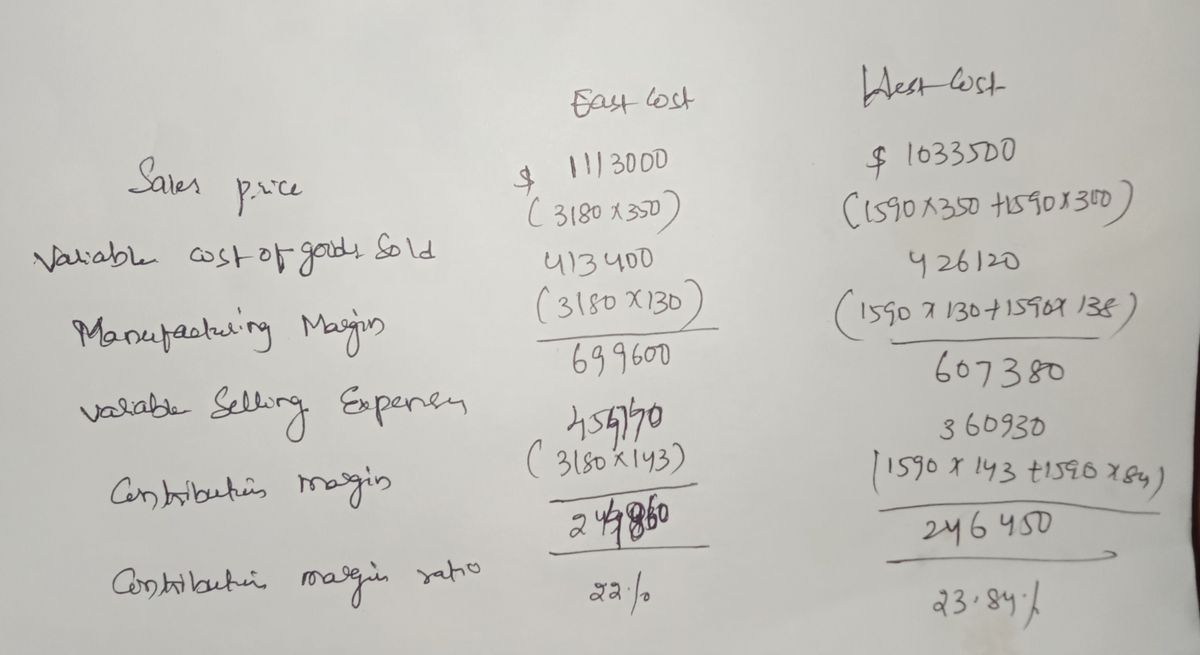

East Coast West Coast $Sales $Sales Variable cost of goods sold Variable cost of goods sold $Manufacturing margin $Manufacturing margin Variable selling expenses Variable selling expenses $Contribution margin $Contribution margin Contribution margin ratio fill in the blank 174ad2025fe604a_16

Question Content Area

Territory and Product Profitability Analysis

Coast to Coast Surfboards Inc. manufactures and sells two styles of surfboards, Atlantic Wave and Pacific Pounder. These surfboards are sold in two regions, East Coast and West Coast. Information about the two surfboards is as follows:

| Atlantic Wave | Pacific Pounder | |||

| Sales price | $350 | $300 | ||

| Variable cost of goods sold per unit | (130) | (138) | ||

| Manufacturing margin per unit | $220 | $162 | ||

| Variable selling expense per unit | (143) | (84) | ||

| Contribution margin per unit | $77 | $78 |

The sales unit volume for the territories and products for the period is as follows:

| East Coast | West Coast | ||||

| Atlantic Wave | 3,180 | 1,590 | |||

| Pacific Pounder | 0 | 1,590 |

Question Content Area

a. Prepare a contribution margin by sales territory report. Compute the contribution margin ratio for each territory as a whole percent, rounded to two decimal places, if required.

| East Coast | West Coast | |

|

|

$Sales | $Sales |

|

|

Variable cost of goods sold | Variable cost of goods sold |

|

|

$Manufacturing margin | $Manufacturing margin |

|

|

Variable selling expenses | Variable selling expenses |

|

|

$Contribution margin | $Contribution margin |

| Contribution margin ratio | fill in the blank 174ad2025fe604a_16% | fill in the blank 174ad2025fe604a_17% |

Computation of the contribution margin ratio for each territory as a whole

Please fallow the below attachment

Note :1.Contribution margin ratio

Contribution margin / sales*100

2.to compute the west cost sales

Then (1590*350+1590*300)=1033500

West cost variable cost of goods sold

(1590*130+1590*138)=426120

West cost variable selling price

(1590*143+1590*84)=360930

West cost contribution margin is the difference between the manufacturing margin -variable selling expense (607380-360930)=246450

Contribution margin ratio is 23.84%

(247450/1033500*100)

Step by step

Solved in 2 steps with 1 images