Due to increased product demand, the Jax Company has insufficient floor space in its current production facility. Three alternative solutions have been identified: (A1) do nothing, (A2) rearrange an area of the existing floor space, or (A3) build an addition to the present plant. Analysis is conducted assuming a five-year planning horizon and an MARR of 30%. There is some uncertainty as to whether Jax will face competition for the new business. If alternative A1 is pursued, the estimated Present Worth will be $0. If alternative A2 is chosen, the Present Worth realized will depend on whether competition arises. Under A2, there is a 60% chance of competition occurring. The estimated PW under A2 will be $50,000 if competition arises; $30,000 if there is no competition. Under A3, there is a 20% chance of competition. The estimated PW under A3 will be -$100,000 if competition arises; $90,000 if there is no competition. (a) Based on expected PW, what course should Jax follow? (b) Are there any risk-related factors that might make you give a different recommendation than the one you have given under (a)? Explain.

Due to increased product demand, the Jax Company has insufficient floor space in its current production facility. Three alternative solutions have been identified: (A1) do nothing, (A2) rearrange an area of the existing floor space, or (A3) build an addition to the present plant. Analysis is conducted assuming a five-year planning horizon and an MARR of 30%. There is some uncertainty as to whether Jax will face competition for the new business. If alternative A1 is pursued, the estimated Present Worth will be $0. If alternative A2 is chosen, the Present Worth realized will depend on whether competition arises. Under A2, there is a 60% chance of competition occurring. The estimated PW under A2 will be $50,000 if competition arises; $30,000 if there is no competition. Under A3, there is a 20% chance of competition. The estimated PW under A3 will be -$100,000 if competition arises; $90,000 if there is no competition. (a) Based on expected PW, what course should Jax follow? (b) Are there any risk-related factors that might make you give a different recommendation than the one you have given under (a)? Explain.

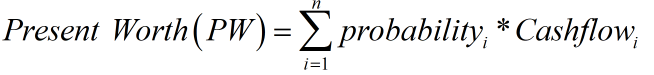

The question is based on the concept of calculation of present worth of the different alternatives, which can be calculated by help of probability approach as,

From the given data:

Answer a) PW of alternative A1,

PWA1= $0

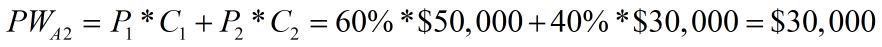

PW of alternative A2,

Probability of 60% of competition occurring will give a value of $50,000 and 40% of no competition will give a value of $30,000.

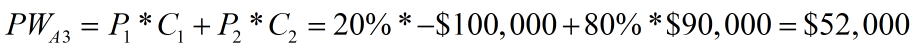

PW of alternative A3,

Probability of 20% of competition occurring will give a value of -$100,000 and 80% of no competition will give a value of $90,000.

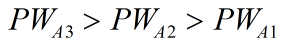

As ,

He will follow the alternative A3

Step by step

Solved in 3 steps with 4 images