Do requirement 1. d, e, f

Chapter1: Financial Statements And Business Decisions

Section: Chapter Questions

Problem 1Q

Related questions

Question

Do requirement 1. d, e, f

Transcribed Image Text:The following data represents the summarized transactions of XYZ Trading for the year 20CY,

its second year of operations.

Cash sales

P 750,000

Purchase return & discounts

P 60,000

Sales on accounts

4,500,000

Salaries and wages paid

1,050,000

Store and office supplies paid

Other operating expenses paid

Collections from customers

4,300,000

300,000

Sales returns & discounts

80,000

100,000

450,000

3,000,000

2,700,000

60,000

600,000

50,000

10,000

Cash purchases

Interest received

Purchases on account

Equipment purchased

Interest paid

Payment to creditors

Rental collections

140,000

Accounts receivable written off

Equipment was acquired at the beginning of its first year with a 10-year useful life.

Additional Information at December 31, 20CY:

Notes & A/c receivable, 12/31/CY

Notes & A/c payable, 12/31/CY

Notes & A/c receivable, 12//31/PY

Notes & A/c payable, 13/31/PY

Accrued salaries payable

Accrued Interest payable

Unused Store & office supplies

Inventory, 12/31/CY

Accrued Interest receivable

Р 320,000

P 540,000

210,000

300,000

110,000

10,000

75,000

600,000

15,000

500,000

20,000

Inventory, 12/13/PY

Unearned rent income

Required:

1.

Compute the following under Cash and Accrual basis of accounting:

e. Interest expense

f. Salaries and wages

g. Store and offices supplies expense

h. Depreciation expense

Total gross sales

Total gross purchase

а.

b.

C.

Interest Income

d.

Rent Income

Statement of Comprehensive Income for the year ended December 31,

20CY under Cash basis of accounting.

3.

Convert the Cash basis Income statement to Accrual basis of accounting.

4. Adjusting entries necessary to convert to Accrual basis.

2.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

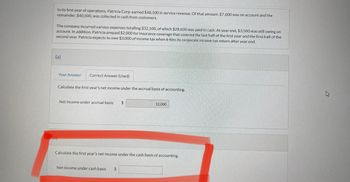

How do you calculate the first years net income under the cash basis of accoun

Transcribed Image Text:In its first year of operations, Patricia Corp. earned $48,100 in service revenue. Of that amount, $7,600 was on account and the

remainder, $40,500, was collected in cash from customers.

The company incurred various expenses totalling $32,100, of which $28,600 was paid in cash. At year end, $3,500 was still owing on

account. In addition, Patricia prepaid $2,000 for insurance coverage that covered the last half of the first year and the first half of the

second year. Patricia expects to owe $3,000 of income tax when it files its corporate income tax return after year end.

(a)

Your Answer Correct Answer (Used)

Calculate the first year's net income under the accrual basis of accounting.

Net income under accrual basis $

12.000

(b)

Calculate the first year's net income under the cash basis of accounting.

Net income under cash basis

ta

2

Solution

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis…

Accounting

ISBN:

9780134475585

Author:

Srikant M. Datar, Madhav V. Rajan

Publisher:

PEARSON

Intermediate Accounting

Accounting

ISBN:

9781259722660

Author:

J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:

McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:

9781259726705

Author:

John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:

McGraw-Hill Education