Differentiate between free and costly trade credit.What is the formula for determining the nominalannual interest rate associated with a credit policy?What is the formula for the effective annual interestrate? How would these cost rates be affected if afirm buying on credit could “stretch” either the discount days or the net payment days—that is, takediscounts on payments made after the discountperiod or else pay later than the stated paymentdate?

Differentiate between free and costly trade credit.

What is the formula for determining the nominal

annual interest rate associated with a credit policy?

What is the formula for the effective annual interest

rate? How would these cost rates be affected if a

firm buying on credit could “stretch” either the discount days or the net payment days—that is, take

discounts on payments made after the discount

period or else pay later than the stated payment

date?

Answer:

Free trade and costly trade credit:

If trading is on credit, the suppliers of products often give discount specifying the condition that if the payables are paid within those days, the customers will get some discount.

For instance, supplier A sells its product to a company named B on credit terms 2/10, net 30. This means, company B receives 2% of discount if it pays to A within 10 days and if it pays within 30 days, then the firm B does not receive any discount on payables.

So, if the firm pays and gets the discount benefit during the discount period that trade credit is called as free trade credit. Includes credit earned during the time of discount.

If company B pays within 30th day, company must to pay full amount of payable and must leave the discount. This foregone discount is causing the costly credit to cost. This is the costly trade credit and is based on foregone discounts.

Formula for nominal annual cost rate:

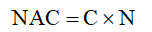

The nominal annual cost rate (NAC) associated with a credit policy can be calculated using cost per period(C) and number of periods per year (N), as shown below:

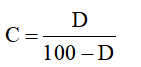

The cost per period(C) can be calculated with discount percentage (D), as shown below,

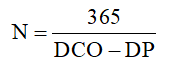

For an outstanding discount period (DP) and days credit is outstanding (DCO), the number of terms (N), can be calculated as shown below:

Step by step

Solved in 4 steps with 4 images