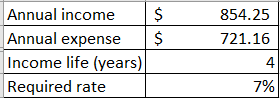

Determine the present value of the income from cotton 4 years from now for full water application and a required rate of return of 7 %. (1) Assume no inflation. (2) Assume inflation of 5 % per year in costs and no inflation in the selling price of cotton. Current yearly income is $854.25, and current yearly expenses are $721.16.

Need help with revising questions. Expected Answers are provided at the end of each question.

Determine the

Answer: With no inflation $451, with inflation -$75.

Develop a rule of thumb for pump flow rate requirement for an area that has a max ET ¼ 10 mm/d in terms of gpm/acre? The expected irrigation efficiency is 70 %, and the expected downtime is 10 %. What pump flow capacity will be required for a 10 acre farm? If the farm is divided into five irrigation zones, then what pump size is required?

Answer: For a 10 acre farm, the pump should produce 106 gal/min. The same pump size is required for any number of zones.

The given details are:

Inflation rate is 5%

Required: Determine the present value of the income:

(1) Assume no inflation.

(2) Assume inflation of 5 % per year in costs and no inflation in the selling price of cotton.

Note: As per our Q&A guidelines, we can only solve the first question when multiple questions are posted. Kindly upload the remaining questions separately.

Step by step

Solved in 4 steps with 5 images