You are analyzing the price/book value ratios for seven firms in the hospitality industry, lative to returns on equity and required rates of return. The treasury bond rate is 6% and e market premium is 3%. The data on the companies are the following: Company P/BV ROE Beta A 0.50 9.0% 0.75 B 1.10 8.5% 0.80 1.20 7.0% 1.30 0.65 12.5% 0.70 1.50 16.0% 0.85 0.90 10.0% 1.40 1.00 18.5% 0.85 i. ii. C D E F G Compute the average P/BV ratio, return on equity, and beta for the industry. Based upon these averages, is the hospitality industry under or overvalued according to book values assuming that the industry overall is in stable growth?

You are analyzing the price/book value ratios for seven firms in the hospitality industry, lative to returns on equity and required rates of return. The treasury bond rate is 6% and e market premium is 3%. The data on the companies are the following: Company P/BV ROE Beta A 0.50 9.0% 0.75 B 1.10 8.5% 0.80 1.20 7.0% 1.30 0.65 12.5% 0.70 1.50 16.0% 0.85 0.90 10.0% 1.40 1.00 18.5% 0.85 i. ii. C D E F G Compute the average P/BV ratio, return on equity, and beta for the industry. Based upon these averages, is the hospitality industry under or overvalued according to book values assuming that the industry overall is in stable growth?

Essentials Of Investments

11th Edition

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Chapter1: Investments: Background And Issues

Section: Chapter Questions

Problem 1PS

Related questions

Question

Transcribed Image Text:A. You are analyzing the price/book value ratios for seven firms in the hospitality industry,

relative to returns on equity and required rates of return. The treasury bond rate is 6% and

the market premium is 3%. The data on the companies are the following:

Company

P/BV

ROE

Beta

A

0.50

9.0%

0.75

1.10

8.5%

0.80

1.20 7.0%

1.30

0.65 12.5%

0.70

1.50

16.0%

0.85

0.90 10.0%

1.40

1.00 18.5%

0.85

i.

ii.

B

C

D

E

F

G

Compute the average P/BV ratio, return on equity, and beta for the industry.

Based upon these averages, is the hospitality industry under or overvalued

according to book values assuming that the industry overall is in stable

growth?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 2 images

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

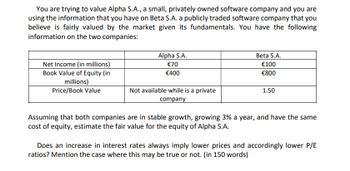

Transcribed Image Text:You are trying to value Alpha S.A., a small, privately owned software company and you are

using the information that you have on Beta S.A. a publicly traded software company that you

believe is fairly valued by the market given its fundamentals. You have the following

information on the two companies:

Net Income (in millions)

Book Value of Equity (in

millions)

Price/Book Value

Alpha S.A.

€70

€400

Not available while is a private

company

Beta S.A.

€100

€800

1.50

Assuming that both companies are in stable growth, growing 3% a year, and have the same

cost of equity, estimate the fair value for the equity of Alpha S.A.

Does an increase in interest rates always imply lower prices and accordingly lower P/E

ratios? Mention the case where this may be true or not. (in 150 words)

Solution

Recommended textbooks for you

Essentials Of Investments

Finance

ISBN:

9781260013924

Author:

Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:

Mcgraw-hill Education,

Essentials Of Investments

Finance

ISBN:

9781260013924

Author:

Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:

Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:

9780134897264

Author:

KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:

Pearson,

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i…

Finance

ISBN:

9780077861759

Author:

Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:

McGraw-Hill Education