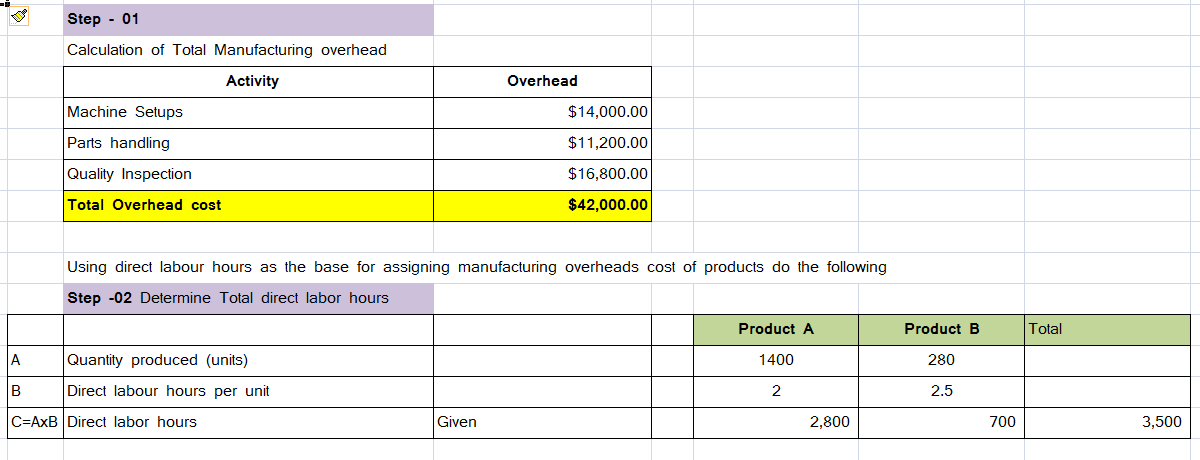

Consider the following data for two products of Vigano Manufacturing. Activity Budgeted Cost Activity Driver (20 machine setups) 11,200 (16,000 parts) (100 inspections) Machine setup $ 14,000 Parts handling Quality inspections 16,800 Total budgeted $ 42,000 overhead Unit Product A Product B Information Units produced Direct materials cost Direct labor 1,400 units 280 units $ 24 per unit $ 34 per unit $ 44 per unit $ 54 per unit cost Direct labor hours 2 per unit 2.50 per unit 1. Using a plantwide overhead rate based on 3,500 direct labor hours, compute the total product cost per unit for ea product. 2. Consider the following additional information about these two products. If activity-based costing is used to allocat overhead cost, (a) compute overhead activity rates, (b) allocate overhead cost to Product A and Product B and comp overhead cost per unit for each, and (c) compute product cost per unit for each. Actual Activity Usage Setups Parts Product A Product B 8 setups 10,000 partS 40 inspections 12 setups 6,000 parts 60 inspections Inspections

Master Budget

A master budget can be defined as an estimation of the revenue earned or expenses incurred over a specified period of time in the future and it is generally prepared on a periodic basis which can be either monthly, quarterly, half-yearly, or annually. It helps a business, an organization, or even an individual to manage the money effectively. A budget also helps in monitoring the performance of the people in the organization and helps in better decision-making.

Sales Budget and Selling

A budget is a financial plan designed by an undertaking for a definite period in future which acts as a major contributor towards enhancing the financial success of the business undertaking. The budget generally takes into account both current and future income and expenses.

Trending now

This is a popular solution!

Step by step

Solved in 5 steps with 5 images