Tranche Senior Mezzanine Subordinated/ equity Par Value $100,000,000 $ 30,000,000 $ 20,000,000 Coupon Rate LIBOR + 50 basis points Treasury rate + 200 basis points None

Tranche Senior Mezzanine Subordinated/ equity Par Value $100,000,000 $ 30,000,000 $ 20,000,000 Coupon Rate LIBOR + 50 basis points Treasury rate + 200 basis points None

Oh no! Our experts couldn't answer your question.

Don't worry! We won't leave you hanging. Plus, we're giving you back one question for the inconvenience.

Submit your question and receive a step-by-step explanation from our experts in as fast as 30 minutes.

You have no more questions left.

Message from our expert:

Hi and thanks for your question! Unfortunately we cannot answer this particular question due to its complexity.

We've credited a question back to your account. Apologies for the inconvenience.

Your Question:

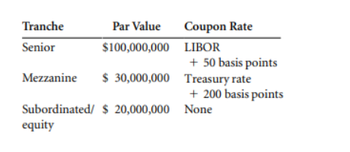

Consider the following basic $150 million CDO structure with the coupon rate to be offered at the time of issuance as shown:

Assume the following:

- The collateral consists of bonds that all mature in 10 years.

- The coupon rate for every bond is the 10-year Treasury rate plus 300 basis points.

- The collateral manager enters into an interest rate swap agreement with another party with a notional amount of $100 million.

- In the interest rate swap the collateral manager agrees to pay a fixed rate each year equal to the 10-year Treasury rate plus 100 basis points and receive LIBOR.

- Why is an interest rate swap needed?

- What is the potential return for the subordinate/ equity tranche, assuming no defaults?

- Why will the actual return be less than the return computed?

Transcribed Image Text:Tranche

Senior

Mezzanine

Subordinated/

equity

Par Value

$100,000,000

$ 30,000,000

$ 20,000,000

Coupon Rate

LIBOR

+ 50 basis points

Treasury rate

+ 200 basis points

None

Recommended textbooks for you