Congratulations! You have been hired by a consulting company to work as a junior financial consultant. Your new responsibilities include assessing clients’ financial situations, developing financial plans to help clients achieve their long-term and short-term financial goals, explaining the pros and cons of various investment strategies, and answering all finance-related questions, and addressing clients’ concerns. Your boss asks you for assistance with a new client, an Italian company Incantieri, which manufactures cruise ships. Incantieri is planning to buy manufacturing facilities in Florida to ensure that production of cruise ships will be located closer to the U.S. clients and potential cruise lines. Incantieri considers the possibility of selling these facilities in one year. As an Italian resident, the company is concerned with the euro value of the property. You have researched and provided your client with the following results: ⦁ If the U.S. economy experiences growth in the future, the property will be worth $50,000,000 and the exchange course of 1 dollar will be 0.83 euro. ⦁ If the U.S. economy slows down, the property will be worth $40,000,000, but the U.S. dollar will be stronger and worth 0.89 euro. ⦁ The probability of the U.S. economy to experience growth is 40% while a slow-down will happen with a 60% probability. 1 Estimate your exposure b to the exchange risk. 2 Compute the variance of the dollar value of your property that is attributable to the exchange rate uncertainty.

Congratulations! You have been hired by a consulting company to work as a junior financial consultant. Your new responsibilities include assessing clients’ financial situations, developing financial plans to help clients achieve their long-term and short-term financial goals, explaining the pros and cons of various investment strategies, and answering all finance-related questions, and addressing clients’ concerns.

Your boss asks you for assistance with a new client, an Italian company Incantieri, which manufactures cruise ships.

Incantieri is planning to buy manufacturing facilities in Florida to ensure that production of cruise ships will be located closer to the U.S. clients and potential cruise lines. Incantieri considers the possibility of selling these facilities in one year. As an Italian resident, the company is concerned with the euro value of the property.

You have researched and provided your client with the following results:

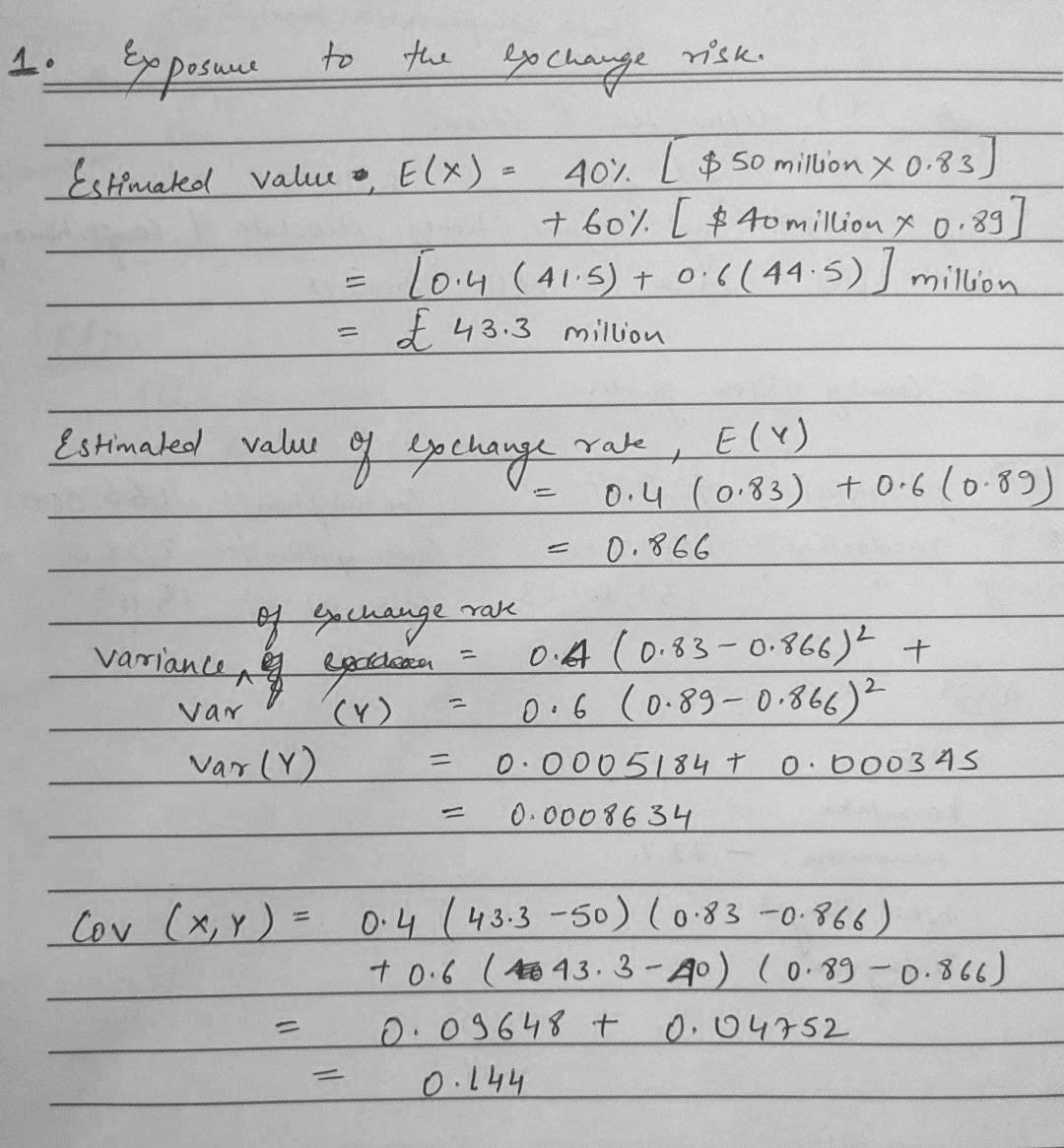

⦁ If the U.S. economy experiences growth in the future, the property will be worth $50,000,000 and the exchange course of 1 dollar will be 0.83 euro.

⦁ If the U.S. economy slows down, the property will be worth $40,000,000, but the U.S. dollar will be stronger and worth 0.89 euro.

⦁ The probability of the U.S. economy to experience growth is 40% while a slow-down will happen with a 60% probability.

1 Estimate your exposure b to the exchange risk.

2 Compute the variance of the dollar value of your property that is attributable to the exchange rate uncertainty.

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images