Concord Toys is exploring options to help reduce overhead costs especially for non-value added activities. One of the proposals is from the National Toy Association. For an additional $1 per order, this entity could perform additional safety checks that would reduce the assembly line inspection costs by $0.01 per toy. Compute the overhead cost assigned to the toddler toy line for the month of August using activity-based costing under this proposal. Overhead cost assigned $

Variance Analysis

In layman's terms, variance analysis is an analysis of a difference between planned and actual behavior. Variance analysis is mainly used by the companies to maintain a control over a business. After analyzing differences, companies find the reasons for the variance so that the necessary steps should be taken to correct that variance.

Standard Costing

The standard cost system is the expected cost per unit product manufactured and it helps in estimating the deviations and controlling them as well as fixing the selling price of the product. For example, it helps to plan the cost for the coming year on the various expenses.

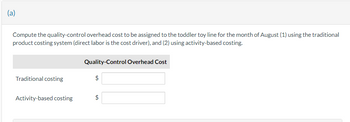

I submitted this question earlier but failed to attach the beginning part of the question. I am not sure how to figure this out

Step by step

Solved in 2 steps