Financial Ratios

A Ratio refers to a figure calculated as a reference to the relationship of two or more numbers and can be expressed as a fraction, proportion, percentage, or the number of times. When the number is determined by taking two accounting numbers derived from the financial statements, it is termed as the accounting ratio.

Return on Equity

The Return on Equity (RoE) is a measure of the profitability of a business concerning the funds by its stockholders/shareholders. ROE is a metric used generally to determine how well the company utilizes its funds provided by the equity shareholders.

See Image for Information

-

Compute the following performance indices for both companies:

-

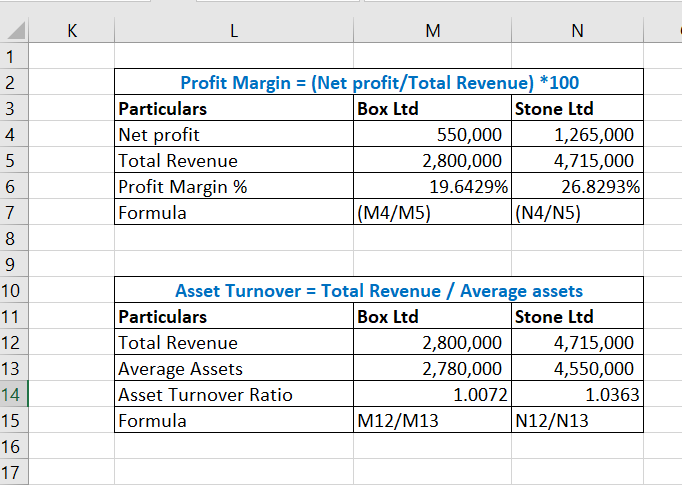

Profit margin

-

Asset turnover

-

Return on Capital Employed (ROCE)

-

Current ratio

-

Debt equity ratio

-

-

Compare and analyse the performance of the two companies computed in (1) above and explain what the board of Box Limited needs to do to achieve their objective .

c. Which other non-financial measures can influence the decision of the board of Box Limited?

As per Bartleby guidelines,If a question with multiple sub-parts are posted, first 3 sub-parts will be answered for you. Kindly resubmit the question with remaining sub-parts to be solved

Step by step

Solved in 2 steps with 2 images