Compounding Effective Period APR per Year Periodic Rate Annual Rate Semiannual 10% 2 ? ? ? ? Quarterly Monthly 11% 4 9.5% 12 ? ? Daily 5% 365 ? ?

Compounding Effective Period APR per Year Periodic Rate Annual Rate Semiannual 10% 2 ? ? ? ? Quarterly Monthly 11% 4 9.5% 12 ? ? Daily 5% 365 ? ?

Essentials Of Investments

11th Edition

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Chapter1: Investments: Background And Issues

Section: Chapter Questions

Problem 1PS

Related questions

Question

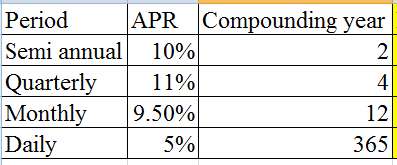

Transcribed Image Text:The table presents various compounding periods with their respective Annual Percentage Rates (APR), compounding frequencies per year, and placeholders for the Periodic Rate and Effective Annual Rate (EAR), which are essential for understanding the actual interest accrued over time.

### Table Breakdown:

- **Period**: Indicates how frequently the interest is compounded within one year.

- Semiannual

- Quarterly

- Monthly

- Daily

- **APR (Annual Percentage Rate)**: Displays the nominal interest rate for each compounding period.

- Semiannual: 10%

- Quarterly: 11%

- Monthly: 9.5%

- Daily: 5%

- **Compounding per Year**: Lists how many times interest is compounded annually.

- Semiannual: 2 times

- Quarterly: 4 times

- Monthly: 12 times

- Daily: 365 times

- **Periodic Rate**: The actual interest rate applied during each compounding period. The table currently shows placeholders (question marks) for these values.

- **Effective Annual Rate (EAR)**: Reflects the actual annual interest gained, factoring in compounding. The table includes placeholders (question marks) for these calculations.

### Explanation

This table helps illustrate the difference between the nominal APR and the actual interest rate realized in practical terms, represented by the EAR. Understanding these concepts is crucial for financial decision-making, illustrating how interest is accumulated and compounded over varying periods.

![**Periodic Interest Rates**

In the following table, fill in the periodic rates and the effective annual rates.

First, fill in the periodic rates in the following table. (*Round to two decimal places.*)

| Period | APR | Compounding per Year | Periodic Rate | Effective Annual Rate |

|--------------|------|----------------------|---------------|-----------------------|

| Semiannual | 10% | 2 | [ ]% | [ ]% |

**Explanation of the Table:**

- **Period**: The time frame for the compounding of interest (e.g., annually, semiannually).

- **APR**: Annual Percentage Rate, which is the interest rate for the whole year.

- **Compounding per Year**: The number of times compounding occurs in a year.

- **Periodic Rate**: The interest rate for each compounding period.

- **Effective Annual Rate**: The equivalent annual interest rate, accounting for compounding within the year.](/v2/_next/image?url=https%3A%2F%2Fcontent.bartleby.com%2Fqna-images%2Fquestion%2Fd8c403c1-73da-4878-97dd-7583351688c0%2F51db2bc8-a167-44f5-86d2-9ea63a5ea89b%2F1n5gh2_processed.png&w=3840&q=75)

Transcribed Image Text:**Periodic Interest Rates**

In the following table, fill in the periodic rates and the effective annual rates.

First, fill in the periodic rates in the following table. (*Round to two decimal places.*)

| Period | APR | Compounding per Year | Periodic Rate | Effective Annual Rate |

|--------------|------|----------------------|---------------|-----------------------|

| Semiannual | 10% | 2 | [ ]% | [ ]% |

**Explanation of the Table:**

- **Period**: The time frame for the compounding of interest (e.g., annually, semiannually).

- **APR**: Annual Percentage Rate, which is the interest rate for the whole year.

- **Compounding per Year**: The number of times compounding occurs in a year.

- **Periodic Rate**: The interest rate for each compounding period.

- **Effective Annual Rate**: The equivalent annual interest rate, accounting for compounding within the year.

Expert Solution

Step 1

Given:

Step by step

Solved in 2 steps with 3 images

Recommended textbooks for you

Essentials Of Investments

Finance

ISBN:

9781260013924

Author:

Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:

Mcgraw-hill Education,

Essentials Of Investments

Finance

ISBN:

9781260013924

Author:

Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:

Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:

9780134897264

Author:

KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:

Pearson,

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i…

Finance

ISBN:

9780077861759

Author:

Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:

McGraw-Hill Education