Cole Company was formed on January 1, 2022, when 300,000 shares of $2 par value common stock were issued for $8 per share. Net income for 2022 was $150,000. Cash dividends of $0.25 per share were declared in December 2022 and paid in January 2023. The following occurred in 2023 :• April 1st, 10,000 treasury shares were purchased for $6 per share.• April 15th, 500 treasury shares were retired. • June 1st, 3,000 treasury shares were reissued for $7.50 per share .• November 1st, 4,000 treasury shares were reissued for $4 per share. • Net Income for 2023 was $200,000. • Cash dividends of $0.50 per share were declared in December 2023, payable in January 2024. Assuming Cole Company uses the cost method to account for treasury stock, prepare the stockholders’ equity section of the balance sheet at December 31, 2023. Also note how many shares of common stock were issued, outstanding, and treasury.

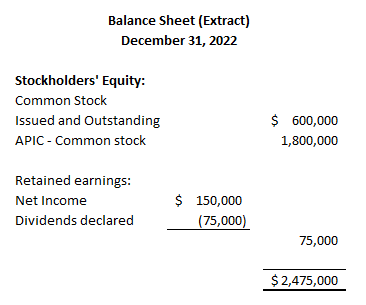

Cole Company was formed on January 1, 2022, when 300,000 shares of $2 par value common stock were issued for $8 per share. Net income for 2022 was $150,000. Cash dividends of $0.25 per share were declared in December 2022 and paid in January 2023.

The following occurred in 2023

:• April 1st, 10,000 treasury shares were purchased for $6 per share.• April 15th, 500 treasury shares were retired.

• June 1st, 3,000 treasury shares were reissued for $7.50 per share

.• November 1st, 4,000 treasury shares were reissued for $4 per share.

• Net Income for 2023 was $200,000.

• Cash dividends of $0.50 per share were declared in December 2023, payable in January 2024.

Assuming Cole Company uses the cost method to account for

Common stock : 300,000 shares x $2 par value per share = $600,000

Additional Paid-in capital -Common stock : 300,000 shares x ($8 - $2) = $1,800,000

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 5 images