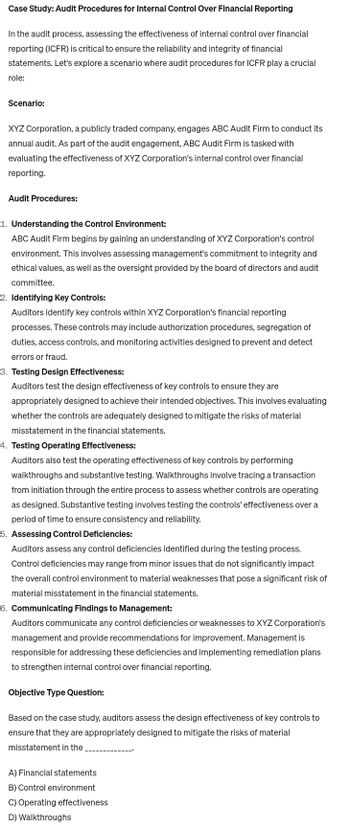

Case Study: Audit Procedures for Internal Control Over Financial Reporting In the audit process, assessing the effectiveness of internal control over financial reporting (ICFR) is critical to ensure the reliability and integrity of financial statements. Let's explore a scenario where audit procedures for ICFR play a crucial role: Scenario: XYZ Corporation, a publicly traded company, engages ABC Audit Firm to conduct its annual audit. As part of the audit engagement, ABC Audit Firm is tasked with evaluating the effectiveness of XYZ Corporation's internal control over financial reporting. Audit Procedures: 1. Understanding the Control Environment: ABC Audit Firm begins by gaining an understanding of XYZ Corporation's control environment. This involves assessing management's commitment to integrity and ethical values, as well as the oversight provided by the board of directors and audit committee. 2. Identifying Key Controls: Auditors identify key controls within XYZ Corporation's financial reporting processes. These controls may include authorization procedures, segregation of duties, access controls, and monitoring activities designed to prevent and detect errors or fraud. 3. Testing Design Effectiveness: Auditors test the design effectiveness of key controls to ensure they are appropriately designed to achieve their intended objectives. This involves evaluating whether the controls are adequately designed to mitigate the risks of material misstatement in the financial statements. 4. Testing Operating Effectiveness: Auditors also test the operating effectiveness of key controls by performing walkthroughs and substantive testing. Walkthroughs involve tracing a transaction from initiation through the entire process to assess whether controls are operating as designed. Substantive testing involves testing the controls' effectiveness over a period of time to ensure consistency and reliability. 5. Assessing Control Deficiencies: Auditors assess any control deficiencies identified during the testing process. Control deficiencies may range from minor issues that do not significantly impact the overall control environment to material weaknesses that pose a significant risk of material misstatement in the financial statements. 6. Communicating Findings to Management: Auditors communicate any control deficiencies or weaknesses to XYZ Corporation's management and provide recommendations for improvement. Management is responsible for addressing these deficiencies and implementing remediation plans to strengthen internal control over financial reporting. Objective Type Question: Based on the case study, auditors assess the design effectiveness of key controls to ensure that they are appropriately designed to mitigate the risks of material misstatement in the A) Financial statements B) Control environment C) Operating effectiveness D) Walkthroughs

Case Study: Audit Procedures for Internal Control Over Financial Reporting In the audit process, assessing the effectiveness of internal control over financial reporting (ICFR) is critical to ensure the reliability and integrity of financial statements. Let's explore a scenario where audit procedures for ICFR play a crucial role: Scenario: XYZ Corporation, a publicly traded company, engages ABC Audit Firm to conduct its annual audit. As part of the audit engagement, ABC Audit Firm is tasked with evaluating the effectiveness of XYZ Corporation's internal control over financial reporting. Audit Procedures: 1. Understanding the Control Environment: ABC Audit Firm begins by gaining an understanding of XYZ Corporation's control environment. This involves assessing management's commitment to integrity and ethical values, as well as the oversight provided by the board of directors and audit committee. 2. Identifying Key Controls: Auditors identify key controls within XYZ Corporation's financial reporting processes. These controls may include authorization procedures, segregation of duties, access controls, and monitoring activities designed to prevent and detect errors or fraud. 3. Testing Design Effectiveness: Auditors test the design effectiveness of key controls to ensure they are appropriately designed to achieve their intended objectives. This involves evaluating whether the controls are adequately designed to mitigate the risks of material misstatement in the financial statements. 4. Testing Operating Effectiveness: Auditors also test the operating effectiveness of key controls by performing walkthroughs and substantive testing. Walkthroughs involve tracing a transaction from initiation through the entire process to assess whether controls are operating as designed. Substantive testing involves testing the controls' effectiveness over a period of time to ensure consistency and reliability. 5. Assessing Control Deficiencies: Auditors assess any control deficiencies identified during the testing process. Control deficiencies may range from minor issues that do not significantly impact the overall control environment to material weaknesses that pose a significant risk of material misstatement in the financial statements. 6. Communicating Findings to Management: Auditors communicate any control deficiencies or weaknesses to XYZ Corporation's management and provide recommendations for improvement. Management is responsible for addressing these deficiencies and implementing remediation plans to strengthen internal control over financial reporting. Objective Type Question: Based on the case study, auditors assess the design effectiveness of key controls to ensure that they are appropriately designed to mitigate the risks of material misstatement in the A) Financial statements B) Control environment C) Operating effectiveness D) Walkthroughs

Oh no! Our experts couldn't answer your question.

Don't worry! We won't leave you hanging. Plus, we're giving you back one question for the inconvenience.

Submit your question and receive a step-by-step explanation from our experts in as fast as 30 minutes.

You have no more questions left.

Message from our expert:

Our experts need more information to provide you with a solution. image is not clear Please resubmit your question, making sure it's detailed and complete. We've credited a question to your account.

Your Question:

Transcribed Image Text:Case Study: Audit Procedures for Internal Control Over Financial Reporting

In the audit process, assessing the effectiveness of internal control over financial

reporting (ICFR) is critical to ensure the reliability and integrity of financial

statements. Let's explore a scenario where audit procedures for ICFR play a crucial

role:

Scenario:

XYZ Corporation, a publicly traded company, engages ABC Audit Firm to conduct its

annual audit. As part of the audit engagement, ABC Audit Firm is tasked with

evaluating the effectiveness of XYZ Corporation's internal control over financial

reporting.

Audit Procedures:

1. Understanding the Control Environment:

ABC Audit Firm begins by gaining an understanding of XYZ Corporation's control

environment. This involves assessing management's commitment to integrity and

ethical values, as well as the oversight provided by the board of directors and audit

committee.

2. Identifying Key Controls:

Auditors identify key controls within XYZ Corporation's financial reporting

processes. These controls may include authorization procedures, segregation of

duties, access controls, and monitoring activities designed to prevent and detect

errors or fraud.

3. Testing Design Effectiveness:

Auditors test the design effectiveness of key controls to ensure they are

appropriately designed to achieve their intended objectives. This involves evaluating

whether the controls are adequately designed to mitigate the risks of material

misstatement in the financial statements.

4. Testing Operating Effectiveness:

Auditors also test the operating effectiveness of key controls by performing

walkthroughs and substantive testing. Walkthroughs involve tracing a transaction

from initiation through the entire process to assess whether controls are operating

as designed. Substantive testing involves testing the controls' effectiveness over a

period of time to ensure consistency and reliability.

5. Assessing Control Deficiencies:

Auditors assess any control deficiencies identified during the testing process.

Control deficiencies may range from minor issues that do not significantly impact

the overall control environment to material weaknesses that pose a significant risk of

material misstatement in the financial statements.

6. Communicating Findings to Management:

Auditors communicate any control deficiencies or weaknesses to XYZ Corporation's

management and provide recommendations for improvement. Management is

responsible for addressing these deficiencies and implementing remediation plans

to strengthen internal control over financial reporting.

Objective Type Question:

Based on the case study, auditors assess the design effectiveness of key controls to

ensure that they are appropriately designed to mitigate the risks of material

misstatement in the

A) Financial statements

B) Control environment

C) Operating effectiveness

D) Walkthroughs

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Auditing: A Risk Based-Approach to Conducting a Q…

Accounting

ISBN:

9781305080577

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

South-Western College Pub

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Auditing: A Risk Based-Approach to Conducting a Q…

Accounting

ISBN:

9781305080577

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

South-Western College Pub