Capital 1 January 2019 350 000 Drawings 20 000 Sales (70% on credit) 950 000 Gross profit 250 000 Total expenses 80 000 Bank favourable 26 000 Net profit 74 000 Trade creditors 26 000 Property, plant and equipment 350 000 Fixed deposit 20 000 Inventory 72 000 Trade Debtors 80 000 Mortgage Loan 100 000 Calculate the following ratios and explain what each ratio means in relation to the industry average given in brackets. Show your calculations as marks will be awarded for these. Round off to 2 decimal places. Q.2.1.4 Current ratio (2:1).

Capital 1 January 2019 350 000 Drawings 20 000 Sales (70% on credit) 950 000 Gross profit 250 000 Total expenses 80 000 Bank favourable 26 000 Net profit 74 000 Trade creditors 26 000 Property, plant and equipment 350 000 Fixed deposit 20 000 Inventory 72 000 Trade Debtors 80 000 Mortgage Loan 100 000 Calculate the following ratios and explain what each ratio means in relation to the industry average given in brackets. Show your calculations as marks will be awarded for these. Round off to 2 decimal places. Q.2.1.4 Current ratio (2:1).

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter4: The Balance Sheet And The Statement Of Shareholders' Equity

Section: Chapter Questions

Problem 16P: Ratios Analyses: McCormick Refer to the information for McCormick above. Additional information for...

Related questions

Question

|

Capital 1 January 2019 |

350 000 |

|

Drawings |

20 000 |

|

Sales (70% on credit) |

950 000 |

|

Gross profit |

250 000 |

|

Total expenses |

80 000 |

|

Bank favourable |

26 000 |

|

Net profit |

74 000 |

|

Trade creditors |

26 000 |

|

Property, plant and equipment |

350 000 |

|

Fixed deposit |

20 000 |

|

Inventory |

72 000 |

|

Trade Debtors |

80 000 |

|

Mortgage Loan |

100 000 |

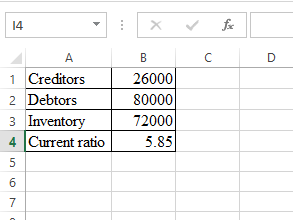

Calculate the following ratios and explain what each ratio means in relation to the industry average given in brackets. Show your calculations as marks will be awarded for these. Round off to 2 decimal places.

|

Q.2.1.4 |

Current ratio (2:1). |

||

Expert Solution

Step 1

Step 2

Computation:

Step by step

Solved in 4 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning