Can you explain rational expectations in detail and elaborate Keynesian and Chicago points of views regarding rational expectations?

Rational Expectations was first introduced by John F. Muth. Rational Expectations is an economic term for the expectations that are based on the information set which includes past information about the variable in question and past information about other relevant variables. It is based on the assumption that people have all the information required to make a reasonable guess about the upcoming value of a given variable.

Let’s say that the variable under consideration is X.

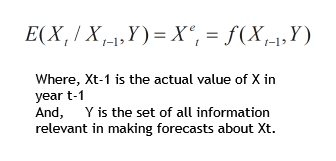

Thus, if X is forecasted for period ‘t’ according to rational expectations, then,

For example, if people have rational expectations and are to expect the price level in period t, then they would base their expectations on past values of prices and the information regarding the level of output, aggregate demand, etc.

Rational expectations provide the best guess about the future values of a given variable. An important implication of rational expectations is that government policy would prove to be ineffective (expansionary fiscal policy would not be able to increase aggregate output) because people would base their expectations based on all available information and adjust their expectations accordingly.

Step by step

Solved in 5 steps with 1 images