Calculate Chee’s taxable income for the year. If Chee has any options, choose the method that maximizes his deductions.

. Chee, single, age 40, had the following income and expenses during 2018:

|

Income |

|

|

Salary |

$43,000 |

|

Rental of vacation home (rented 60 days, used |

|

|

personally 60 days, vacant 245 days) |

4,000 |

|

Municipal bond interest |

2,000 |

|

Dividend from General Electric |

400 |

|

Expenses |

|

|

Interest on home mortgage |

8,400 |

|

Interest on vacation home |

4,758 |

|

Interest on loan used to buy municipal bonds |

3,100 |

|

Property tax on home |

2,200 |

|

Property tax on vacation home |

1,098 |

|

State income tax |

3,300 |

|

State sales tax |

900 |

|

Charitable contributions |

1,100 |

|

Tax return preparation fee |

300 |

|

Utilities and maintenance on vacation home |

2,600 |

|

|

3,500 |

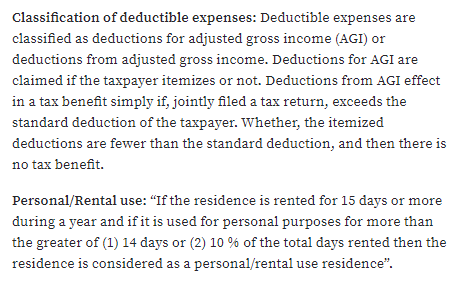

Calculate Chee’s taxable income for the year. If Chee has any options, choose the method that maximizes his deductions.

Trending now

This is a popular solution!

Step by step

Solved in 5 steps with 7 images