The common stock of the C.A.L.L. Corporation has been trading in a narrow range around $105 per share for months, and you believe it is going to stay in that range for the next 3 months. The price of a 3-month put option with an exercise price of $105 is $12.86. a. If the risk-free interest rate is 5% per year, what must be the price of a 3-month call option on C.A.L.L. stock at an exercise price of $105 if it is at the money? (The stock pays no dividends.) (Do not round intermediate calculations. Round your answer to 2 decimal places.) Price of a 3-month call option

The common stock of the C.A.L.L. Corporation has been trading in a narrow range around $105 per share for months, and you believe it is going to stay in that range for the next 3 months. The price of a 3-month put option with an exercise price of $105 is $12.86. a. If the risk-free interest rate is 5% per year, what must be the price of a 3-month call option on C.A.L.L. stock at an exercise price of $105 if it is at the money? (The stock pays no dividends.) (Do not round intermediate calculations. Round your answer to 2 decimal places.) Price of a 3-month call option

Essentials Of Investments

11th Edition

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Chapter1: Investments: Background And Issues

Section: Chapter Questions

Problem 1PS

Related questions

Question

Transcribed Image Text:### Option Pricing Problem

**Scenario:**

The common stock of the C.A.L.L. Corporation has been trading in a narrow range around $105 per share for several months. You believe it will remain in that range for the next 3 months. The price of a 3-month put option with an exercise price of $105 is $12.86.

**Question:**

a. If the risk-free interest rate is 5% per year, what must be the price of a 3-month call option on C.A.L.L. stock at an exercise price of $105 if it is at the money? (The stock pays no dividends.)

**Instructions:**

- Do not round intermediate calculations.

- Round your answer to 2 decimal places.

```plaintext

Price of a 3-month call option: ____________________

```

### Explanation

This problem is seeking the price of a three-month call option given the specific conditions outlined. When determining the price of the call option, consider the principles of option pricing models such as the Black-Scholes model. You’ll use the provided data points to arrive at your answer.

![### Options Trading Exercise

This exercise focuses on the evaluation of options trading strategies and their potential outcomes.

#### Question b-2:

**What is the most money you can make on this position?** *(Do not round intermediate calculations. Round your answer to 2 decimal places.)*

**Answer:**

- **Amount:** [Enter your calculated value]

#### Question b-3:

**How far can the stock price move in either direction before you lose money?** *(Do not round intermediate calculations. Round your answer to 2 decimal places.)*

**Answer:**

- **Stock Price:** [Enter your calculated value]

#### Question c:

**How can you create a position involving a put, a call, and riskless lending that would have the same payoff structure as the stock at expiration?**

**What is the net cost of establishing that position now?** *(Enter the absolute value. Do not round intermediate calculations. Round your answers to 2 decimal places. Leave no cells blank - be certain to enter "0" wherever required.)*

**Answer:**

- [Provide the solution and explanation of the strategy]

**Note:**

When answering these questions, ensure accuracy by not rounding any figures during intermediate steps. The final answers should be rounded to two decimal places as specified.](/v2/_next/image?url=https%3A%2F%2Fcontent.bartleby.com%2Fqna-images%2Fquestion%2Ff1fd60a6-e122-44a6-b63f-53f11d7f8fb8%2F82ac1960-f24f-433c-824c-b6fa30d197de%2Fu9bmd07_processed.png&w=3840&q=75)

Transcribed Image Text:### Options Trading Exercise

This exercise focuses on the evaluation of options trading strategies and their potential outcomes.

#### Question b-2:

**What is the most money you can make on this position?** *(Do not round intermediate calculations. Round your answer to 2 decimal places.)*

**Answer:**

- **Amount:** [Enter your calculated value]

#### Question b-3:

**How far can the stock price move in either direction before you lose money?** *(Do not round intermediate calculations. Round your answer to 2 decimal places.)*

**Answer:**

- **Stock Price:** [Enter your calculated value]

#### Question c:

**How can you create a position involving a put, a call, and riskless lending that would have the same payoff structure as the stock at expiration?**

**What is the net cost of establishing that position now?** *(Enter the absolute value. Do not round intermediate calculations. Round your answers to 2 decimal places. Leave no cells blank - be certain to enter "0" wherever required.)*

**Answer:**

- [Provide the solution and explanation of the strategy]

**Note:**

When answering these questions, ensure accuracy by not rounding any figures during intermediate steps. The final answers should be rounded to two decimal places as specified.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 6 steps with 6 images

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

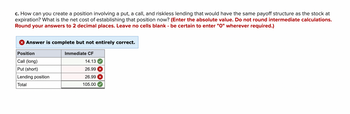

the answer was partially incorrect, entered it in as positive and negative, see attached

Transcribed Image Text:### Creating a Position Involving a Put, Call, and Riskless Lending

#### Problem Statement:

How can you create a position involving a put, a call, and riskless lending that would have the same payoff structure as the stock at expiration? What is the net cost of establishing that position now?

**Requirements:**

- Enter the absolute value.

- Do not round intermediate calculations.

- Round your answers to 2 decimal places.

- Leave no cells blank - enter "0" wherever required.

#### Table of Positions and Immediate Cash Flows:

The table outlines different positions and their immediate cash flows (CF):

| Position | Immediate CF |

|------------------|--------------|

| Call (long) | 14.13 |

| Put (short) | 26.99 |

| Lending position | 26.99 |

| **Total** | **105.00** |

Each row represents a financial position:

- **Call (long):** Buying a call option.

- **Put (short):** Selling a put option.

- **Lending position:** Engaging in a riskless lending strategy.

The immediate CF (cash flow) values for these positions are:

- **Call (long):** 14.13

- **Put (short):** 26.99

- **Lending position:** 26.99

The total immediate cost of establishing all these positions is 105.00.

#### Observations:

- The checkbox symbols (✓ and ✗) next to each value indicate:

- Green check ✓: The value is correct.

- Red cross ✗: The value is incorrect.

- Based on the current data, the only correct value is the total of 105.00.

#### Explanation of Approach:

In this scenario, the goal is to mimic the stock payoff at expiration using a combination of options and risk-free lending. This typically involves:

- Holding a long position in a call option.

- Shorting a put option.

- Entering into a risk-free lending position to equate the payoff at the expiration.

Each component here is intended to balance out to represent the net payoff structure of holding the stock itself at expiration, helping to determine the combined net cost of initiating these positions right now.

Transcribed Image Text:### Question:

How can you create a position involving a put, a call, and riskless lending that would have the same payoff structure as the stock at expiration? What is the net cost of establishing that position now? (Enter the absolute value. Do not round intermediate calculations. Round your answers to 2 decimal places. Leave no cells blank - be certain to enter "0" wherever required.)

### Answer:

The provided solution is complete but not entirely correct.

#### Immediate Cash Flows:

| **Position** | **Immediate CF** |

|------------------|------------------|

| Call (long) | 14.13 |

| Put (short) | (26.99) |

| Lending position | (26.99) |

| **Total** | 105.00 |

This table outlines the immediate cash flows from each position:

- **Call (long):** Buying a call option has an immediate cash flow of \$14.13.

- **Put (short):** Selling a put option has an immediate cash flow of \$(26.99).

- **Lending Position:** Engaging in a lending position has an immediate cash flow of \$(26.99), which seems likely to be an error.

- **Total:** The total net cost is stated as \$105.00, but the sum of the provided values does not equate to this, indicating a potential calculation error.

### Explanation:

1. **Call (long):** This is the purchase of a call option, which gives the right to buy the stock at a specific price. The cost is \$14.13.

2. **Put (short):** This is the sale of a put option, which obligates the seller to buy the stock at a specific price if the buyer exercises the option. The proceeds from this position are \$(26.99).

3. **Lending Position:** This represents borrowing or lending at a risk-free rate. The indicated cost here is \$(26.99), typically this would be either an inflow or outflow representing the financing cost or proceeds.

The expectation is to combine these positions to replicate the payoff of holding the stock. The total calculated should be revisited as there might be an inconsistency in the values provided.

### Corrections:

1. Reassess the immediate cash flows for accuracy.

2. Ensure all calculations are accurate and rounded appropriately as per the instructions.

This understanding aids in

Solution

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Essentials Of Investments

Finance

ISBN:

9781260013924

Author:

Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:

Mcgraw-hill Education,

Essentials Of Investments

Finance

ISBN:

9781260013924

Author:

Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:

Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:

9780134897264

Author:

KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:

Pearson,

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i…

Finance

ISBN:

9780077861759

Author:

Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:

McGraw-Hill Education