by sign. as a percent rounded to 2 decimal places, e.g., 32.16.) Answer is not complete. c-1. Recession ROE c-1. Normal ROE c-1. Expansion ROE c-2. Recession percentage change in ROE c-2. Expansion percentage change in ROE c-3. Recession ROE c-3. Normal ROE c-3. Expansion ROE c-4. Recession percentage change in ROE c-4. Expansion percentage change in ROE -25.00 16.00 -30.49 19.51 % % % % % %

by sign. as a percent rounded to 2 decimal places, e.g., 32.16.) Answer is not complete. c-1. Recession ROE c-1. Normal ROE c-1. Expansion ROE c-2. Recession percentage change in ROE c-2. Expansion percentage change in ROE c-3. Recession ROE c-3. Normal ROE c-3. Expansion ROE c-4. Recession percentage change in ROE c-4. Expansion percentage change in ROE -25.00 16.00 -30.49 19.51 % % % % % %

Essentials Of Investments

11th Edition

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Chapter1: Investments: Background And Issues

Section: Chapter Questions

Problem 1PS

Related questions

Question

![Problem 16-3 ROE and Leverage [LO1, 2]

Fujita, Incorporated, has no debt outstanding and a total market value of $356,900.

Earnings before Interest and taxes, EBIT, are projected to be $50,000 if economic

conditions are normal. If there is strong expansion in the economy, then EBIT will be 16

percent higher. If there is a recession, then EBIT will be 25 percent lower. The

company is considering a $180,000 debt Issue with an interest rate of 5 percent. The

proceeds will be used to repurchase shares of stock. There are currently 8,300 shares

outstanding. Ignore taxes for questions (a) and (b). Assume the company has a market-

to-book ratio of 1.0 and the stock price remains constant.

a-1. Calculate return on equity (ROE) under each of the three economic scenarios before

any debt is issued. (Do not round Intermediate calculations and enter your

answers as a percent rounded to 2 decimal places, e.g., 32.16.)

a-2. Calculate the percentage changes in ROE when the economy expands or enters a

recession. (A negative answer should be indicated by a minus sign. Do not round

Intermediate calculations and enter your answers as a percent rounded to 2

decimal places, e.g., 32.16.)

b-1. Assume the firm goes through with the proposed recapitalization. Calculate the

return on equity (ROE) under each of the three economic scenarios. (Do not round

Intermediate calculations and enter your answers as a percent rounded to 2

decimal places, e.g., 32.16.)

b-2. Assume the firm goes through with the proposed recapitalization. Calculate the

percentage changes in ROE when the economy expands or enters a recession. (A

negative answer should be indicated by a minus sign. Do not round Intermediate

calculations and enter your answers as a percent rounded to 2 decimal places,

e.g., 32.16.)

a-1. Recession ROE

a-1. Normal ROE

Answer is complete and correct.

a-1. Expansion ROE

a-2. Recession percentage change in ROE

a-2. Expansion percentage change in ROE

b-1. Recession ROE

b-1. Normal ROE

b-1. Expansion ROE

b-2. Recession percentage change in ROE

b-2. Expansion percentage change in ROE

%

10.51

14.01 %

16.25

%

-25.00

%

16.00

%

16.11 %

23.18✔ %

27.70 %

-30.49

%

19.51

%](/v2/_next/image?url=https%3A%2F%2Fcontent.bartleby.com%2Fqna-images%2Fquestion%2F5fa70c8e-c2c0-4088-8b85-2c424d967865%2Fabd1baa7-9762-4477-8332-8d2ed2b4aaa9%2F767fsgr_processed.png&w=3840&q=75)

Transcribed Image Text:Problem 16-3 ROE and Leverage [LO1, 2]

Fujita, Incorporated, has no debt outstanding and a total market value of $356,900.

Earnings before Interest and taxes, EBIT, are projected to be $50,000 if economic

conditions are normal. If there is strong expansion in the economy, then EBIT will be 16

percent higher. If there is a recession, then EBIT will be 25 percent lower. The

company is considering a $180,000 debt Issue with an interest rate of 5 percent. The

proceeds will be used to repurchase shares of stock. There are currently 8,300 shares

outstanding. Ignore taxes for questions (a) and (b). Assume the company has a market-

to-book ratio of 1.0 and the stock price remains constant.

a-1. Calculate return on equity (ROE) under each of the three economic scenarios before

any debt is issued. (Do not round Intermediate calculations and enter your

answers as a percent rounded to 2 decimal places, e.g., 32.16.)

a-2. Calculate the percentage changes in ROE when the economy expands or enters a

recession. (A negative answer should be indicated by a minus sign. Do not round

Intermediate calculations and enter your answers as a percent rounded to 2

decimal places, e.g., 32.16.)

b-1. Assume the firm goes through with the proposed recapitalization. Calculate the

return on equity (ROE) under each of the three economic scenarios. (Do not round

Intermediate calculations and enter your answers as a percent rounded to 2

decimal places, e.g., 32.16.)

b-2. Assume the firm goes through with the proposed recapitalization. Calculate the

percentage changes in ROE when the economy expands or enters a recession. (A

negative answer should be indicated by a minus sign. Do not round Intermediate

calculations and enter your answers as a percent rounded to 2 decimal places,

e.g., 32.16.)

a-1. Recession ROE

a-1. Normal ROE

Answer is complete and correct.

a-1. Expansion ROE

a-2. Recession percentage change in ROE

a-2. Expansion percentage change in ROE

b-1. Recession ROE

b-1. Normal ROE

b-1. Expansion ROE

b-2. Recession percentage change in ROE

b-2. Expansion percentage change in ROE

%

10.51

14.01 %

16.25

%

-25.00

%

16.00

%

16.11 %

23.18✔ %

27.70 %

-30.49

%

19.51

%

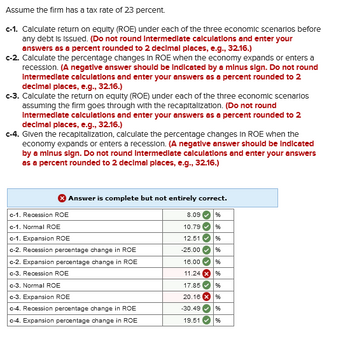

Transcribed Image Text:Assume the firm has a tax rate of 23 percent.

c-1. Calculate return on equity (ROE) under each of the three economic scenarios before

any debt is Issued. (Do not round Intermediate calculations and enter your

answers as a percent rounded to 2 decimal places, e.g., 32.16.)

c-2. Calculate the percentage changes in ROE when the economy expands or enters a

recession. (A negative answer should be indicated by a minus sign. Do not round

Intermediate calculations and enter your answers as a percent rounded to 2

decimal places, e.g., 32.16.)

c-3. Calculate the return on equity (ROE) under each of the three economic scenarios

assuming the firm goes through with the recapitalization. (Do not round

Intermediate calculations and enter your answers as a percent rounded to 2

decimal places, e.g., 32.16.)

c-4. Given the recapitalization, calculate the percentage changes in ROE when the

economy expands or enters a recession. (A negative answer should be indicated

by a minus sign. Do not round Intermediate calculations and enter your answers

as a percent rounded to 2 decimal places, e.g., 32.16.)

Answer is not complete.

c-1. Recession ROE

c-1. Normal ROE

c-1. Expansion ROE

c-2. Recession percentage change in ROE

c-2. Expansion percentage change in ROE

c-3. Recession ROE

c-3. Normal ROE

c-3. Expansion ROE

c-4. Recession percentage change in ROE

c-4. Expansion percentage change in ROE

-25.00

16.00

-30.49

19.51

%

%

%

%

%

%

%

%

%

%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps with 7 images

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

Transcribed Image Text:Assume the firm has a tax rate of 23 percent.

c-1. Calculate return on equity (ROE) under each of the three economic scenarios before

any debt is Issued. (Do not round Intermediate calculations and enter your

answers as a percent rounded to 2 decimal places, e.g., 32.16.)

c-2. Calculate the percentage changes in ROE when the economy expands or enters a

recession. (A negative answer should be indicated by a minus sign. Do not round

Intermediate calculations and enter your answers as a percent rounded to 2

decimal places, e.g., 32.16.)

c-3. Calculate the return on equity (ROE) under each of the three economic scenarios

assuming the firm goes through with the recapitalization. (Do not round

Intermediate calculations and enter your answers as a percent rounded to 2

decimal places, e.g., 32.16.)

c-4. Given the recapitalization, calculate the percentage changes in ROE when the

economy expands or enters a recession. (A negative answer should be indicated

by a minus sign. Do not round Intermediate calculations and enter your answers

as a percent rounded to 2 decimal places, e.g., 32.16.)

Answer is complete but not entirely correct.

c-1. Recession ROE

c-1. Normal ROE

c-1. Expansion ROE

c-2. Recession percentage change in ROE

c-2. Expansion percentage change in ROE

c-3. Recession ROE

c-3. Normal ROE

c-3. Expansion ROE

c-4. Recession percentage change in ROE

c-4. Expansion percentage change in ROE

8.09 %

10.79

%

12.51

%

-25.00

%

16.00✔ %

11.24

%

17.85

%

20.16 x %

-30.49 %

19.51

%

(3

Solution

Recommended textbooks for you

Essentials Of Investments

Finance

ISBN:

9781260013924

Author:

Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:

Mcgraw-hill Education,

Essentials Of Investments

Finance

ISBN:

9781260013924

Author:

Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:

Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:

9780134897264

Author:

KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:

Pearson,

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i…

Finance

ISBN:

9780077861759

Author:

Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:

McGraw-Hill Education