Bishop Co has previously calculated figures as follows: Ke = 18.5%, market value of 1 ordinary share = $2.50 Kp = 5.4%, market value of one preference share = $1.95 Kd(1–t)’ (irredeemable debt) = 7%, market value per $100 nominal value =$105 Kd(1–t)’ (redeemable debt) = 6.9%, market value per $100 nominal value =$93.96 Kd(1–t)’ (non tradable debt) = 5.4%, book value $2m. Kp = 6%, market value of one preference share(non-cummulative) = $1.70 In addition the following information is relevant: Ordinary shares in issue 3.8 million Preference shares in issue 2.5 million Preference shares (non-cummulative) in issue 1 million Nominal value in issue of irredeemable loan notes = $6 million Nominal value of redeemable loan notes in issue = $0.8 million. Required:- Calculate the current WACC by market value

Bishop Co has previously calculated figures as follows:

Ke = 18.5%, market value of 1 ordinary share = $2.50

Kp = 5.4%, market value of one

Kd(1–t)’ (irredeemable debt) = 7%, market value per $100 nominal

value =$105

Kd(1–t)’ (redeemable debt) = 6.9%, market value per $100 nominal

value =$93.96

Kd(1–t)’ (non tradable debt) = 5.4%, book value $2m.

Kp = 6%, market value of one preference share(non-cummulative)

= $1.70

In addition the following information is relevant:

Ordinary shares in issue 3.8 million

Preference shares in issue 2.5 million

Preference shares (non-cummulative) in issue 1 million

Nominal value in issue of irredeemable loan notes = $6 million

Nominal value of redeemable loan notes in issue = $0.8 million.

Required:-

Calculate the current WACC by market values.

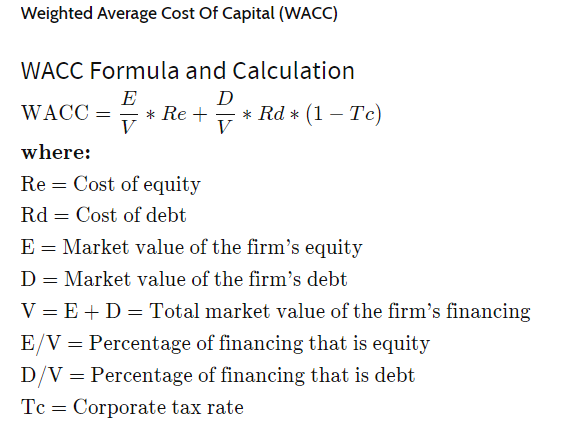

WACC is Weighted Average Cost of Capital which refers to the firm's cost of capital in which each category is proportionately weighted. Different capital sources like bonds, preferred stock or common stock ,all long term debts are weighted and included under WACC calculation. An increase in WACC denotes decrease in valuation and increase in risk.

Formula is :

Step by step

Solved in 2 steps with 1 images