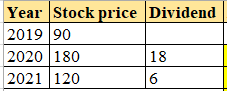

Below is the stock price and dividend history for No-Cameras-Allowed Inc. (NCA), company organizing Las Vegas retreats for investment banks. Year Stock Price (end-of-year) Dividend (paid during the year) 2019 90 2020 180 18 2021 120 6. a. Compute the annual return in 2020 and 2021. b. Compute the arithmetic average return over the 2019–2021 period. c. Compute the geometric average return over the 2019–2021 period. d You bhuy 2. 000 obon

Below is the stock price and dividend history for No-Cameras-Allowed Inc. (NCA), company organizing Las Vegas retreats for investment banks. Year Stock Price (end-of-year) Dividend (paid during the year) 2019 90 2020 180 18 2021 120 6. a. Compute the annual return in 2020 and 2021. b. Compute the arithmetic average return over the 2019–2021 period. c. Compute the geometric average return over the 2019–2021 period. d You bhuy 2. 000 obon

Essentials Of Investments

11th Edition

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Chapter1: Investments: Background And Issues

Section: Chapter Questions

Problem 1PS

Related questions

Question

Transcribed Image Text:O Below is the stock price and dividend history for No-Cameras-Allowed Inc. (NCA), a

company organizing Las Vegas retreats for investment banks.

Stock Price (end-of-year)

Dividend (paid during the year)

Year

2019

90

180

18

2020

2021

120

6.

a. Compute the annual return in 2020 and 2021.

b. Compute the arithmetic average return over the 2019–2021 period.

c. Compute the geometric average return over the 2019–2021 period.

d. You buy 2,000 shares of NCA at the end of 2019 and hold them through the

end of 2021. You reinvest any dividends received (i.e., you use the dividend

proceeds to buy more shares of NCA). Except for reinvestment of dividends,

you neither buy nor sell any shares before the end of 2021.

Which average, arithmetic or geometric, better captures your investment

performance over the 2019–2021 period? Please provide a brief explanation for

your answer.

B Focus

MacBook Pro

Expert Solution

Given Details:

Honor Code:

Hi there, thanks for posting the questions. But as per our Q&A guidelines, we must answer the first three sub-parts when multiple questions posted under single question. Hence the answer for first three sub-parts provided below. Please repost the remaining subparts with complete question Information

Given Details:

Step by step

Solved in 3 steps with 3 images

Recommended textbooks for you

Essentials Of Investments

Finance

ISBN:

9781260013924

Author:

Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:

Mcgraw-hill Education,

Essentials Of Investments

Finance

ISBN:

9781260013924

Author:

Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:

Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:

9780134897264

Author:

KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:

Pearson,

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i…

Finance

ISBN:

9780077861759

Author:

Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:

McGraw-Hill Education