You place an order for 470 units of inventory at a unit price of $175. The supplier offers terms of 2/15, net 90. a-1. How long do you have to pay before the account is overdue? a-2. If you take the full period, how much should you remit? (Do not round intermediate calculations and round your answer to the nearest whole number, e.g., 32.) b-1. What is the discount being offered?

You place an order for 470 units of inventory at a unit price of $175. The supplier offers terms of 2/15, net 90. a-1. How long do you have to pay before the account is overdue? a-2. If you take the full period, how much should you remit? (Do not round intermediate calculations and round your answer to the nearest whole number, e.g., 32.) b-1. What is the discount being offered?

Essentials Of Investments

11th Edition

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Chapter1: Investments: Background And Issues

Section: Chapter Questions

Problem 1PS

Related questions

Concept explainers

Question

![**Educational Website Content**

---

**Invoice Payment Terms and Discount Calculations**

*Scenario:*

You place an order for 470 units of inventory at a unit price of $175. The supplier offers terms of 2/15, net 90.

**Questions:**

**a-1. Days Until Overdue:**

- How long do you have to pay before the account is overdue?

**a-2. Full Period Remittance:**

- If you take the full period, how much should you remit? *(Do not round intermediate calculations and round your answer to the nearest whole number, e.g., 32.)*

**b-1. Discount Offered:**

- What is the discount being offered?

**b-2. Discount Payment Period:**

- How quickly must you pay to get the discount?

**b-3. Discounted Remittance:**

- If you do take the discount, how much should you remit? *(Do not round intermediate calculations and round your answer to the nearest whole number, e.g., 32.)*

**c-1. Implicit Interest:**

- If you don’t take the discount, how much interest are you paying implicitly? *(Do not round intermediate calculations and round your answer to the nearest whole number, e.g., 32.)*

**c-2. Days' Credit:**

- How many days’ credit are you receiving? *(Do not round intermediate calculations and round your answer to the nearest whole number, e.g., 32.)*

**Data Entry:**

- **a-1. Days until overdue:** [ ] days

- **a-2. Remittance:** [ ]

- **b-1. Discount offered:** [ ] %

- **b-2. Number of days:** [ ] days

- **b-3. Remittance:** [ ]

- **c-1. Implicit interest:** [ ]

- **c-2. Days' credit:** [ ] days

*Note for Students:*

Ensure to calculate with accuracy and follow the instructions regarding rounding numbers. This practice will help in understanding the cost of trade credit and making informed financial decisions.

---

*Use this content to better grasp invoice terms and the impact of payment timing on total costs.*](/v2/_next/image?url=https%3A%2F%2Fcontent.bartleby.com%2Fqna-images%2Fquestion%2Ff00761e5-6ea2-4b64-9c87-d0591240e351%2F4ff77725-6569-48d6-b7e3-4e331be41354%2Fyyy0sa_processed.png&w=3840&q=75)

Transcribed Image Text:**Educational Website Content**

---

**Invoice Payment Terms and Discount Calculations**

*Scenario:*

You place an order for 470 units of inventory at a unit price of $175. The supplier offers terms of 2/15, net 90.

**Questions:**

**a-1. Days Until Overdue:**

- How long do you have to pay before the account is overdue?

**a-2. Full Period Remittance:**

- If you take the full period, how much should you remit? *(Do not round intermediate calculations and round your answer to the nearest whole number, e.g., 32.)*

**b-1. Discount Offered:**

- What is the discount being offered?

**b-2. Discount Payment Period:**

- How quickly must you pay to get the discount?

**b-3. Discounted Remittance:**

- If you do take the discount, how much should you remit? *(Do not round intermediate calculations and round your answer to the nearest whole number, e.g., 32.)*

**c-1. Implicit Interest:**

- If you don’t take the discount, how much interest are you paying implicitly? *(Do not round intermediate calculations and round your answer to the nearest whole number, e.g., 32.)*

**c-2. Days' Credit:**

- How many days’ credit are you receiving? *(Do not round intermediate calculations and round your answer to the nearest whole number, e.g., 32.)*

**Data Entry:**

- **a-1. Days until overdue:** [ ] days

- **a-2. Remittance:** [ ]

- **b-1. Discount offered:** [ ] %

- **b-2. Number of days:** [ ] days

- **b-3. Remittance:** [ ]

- **c-1. Implicit interest:** [ ]

- **c-2. Days' credit:** [ ] days

*Note for Students:*

Ensure to calculate with accuracy and follow the instructions regarding rounding numbers. This practice will help in understanding the cost of trade credit and making informed financial decisions.

---

*Use this content to better grasp invoice terms and the impact of payment timing on total costs.*

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 5 steps

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

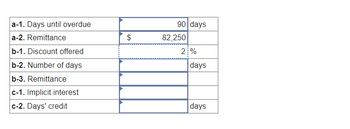

Transcribed Image Text:### Payment Terms Overview

This table outlines various parameters associated with payment terms:

- **a-1. Days until overdue:**

- Value: 90 days

- Description: The number of days remaining before the payment is considered overdue.

- **a-2. Remittance:**

- Value: $82,250

- Description: The amount to be paid.

- **b-1. Discount offered:**

- Value: 2%

- Description: The percentage discount available if the payment is made within a specific timeframe.

- **b-2. Number of days:**

- Value: N/A (to be filled)

- Description: The number of days within which the discount can be applied.

- **b-3. Remittance:**

- Value: N/A (to be filled)

- Description: Adjusted payment amount after applying the discount.

- **c-1. Implicit interest:**

- Value: N/A (to be filled)

- Description: The implicit interest rate based on the discount terms and payment period.

- **c-2. Days' credit:**

- Value: N/A (to be filled)

- Description: The credit period offered minus the discount period.

This table is useful for understanding and calculating the financial implications of payment terms and discounts in transactional agreements.

Solution

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Essentials Of Investments

Finance

ISBN:

9781260013924

Author:

Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:

Mcgraw-hill Education,

Essentials Of Investments

Finance

ISBN:

9781260013924

Author:

Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:

Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:

9780134897264

Author:

KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:

Pearson,

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i…

Finance

ISBN:

9780077861759

Author:

Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:

McGraw-Hill Education