Assume that using the Security Market Line (SML) the required rate of return (RA) on stock A is found to be half of the required return (RB) on stock B. The risk-free rate (Rf) is one-fourth of the required return on A. Return on market portfolio is denoted by RM. Find the ratio of beta of A to beta of B.

Assume that using the Security Market Line (SML) the required

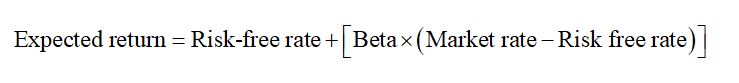

Capital Asset Pricing Model (CAPM):

CAPM is the method of calculating the expected return on investment. The formula to calculate the expected return using the CAPM model is:

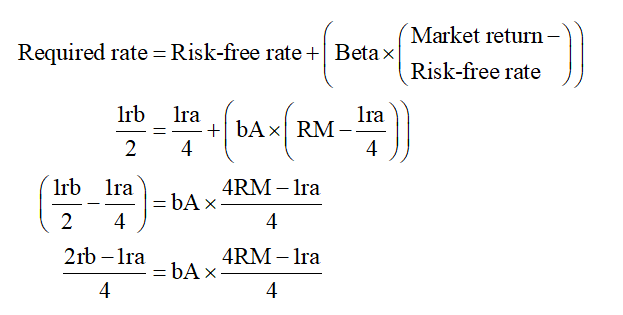

The required rate of return (RA) on stock A 1/2 return on stock B. The risk-free rate is 1/4 return on stock A. The market portfolio is RM.

Compute the beta of A (bA), using the equation as shown below:

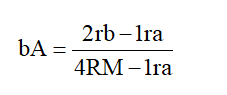

Rearrange the above-mentioned equation to determine the beta of A as follows:

Hence, the beta of A (bA) is computed above.

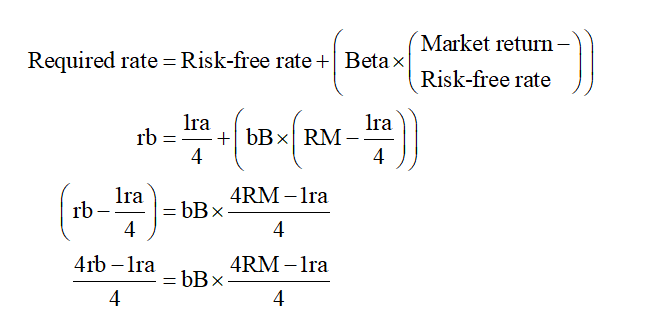

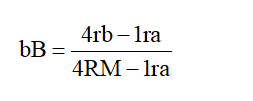

Compute the beta of B (bB), using the equation as shown below:

Rearrange the above-mentioned equation to determine the beta of B as follows:

Hence, the beta of B (bB) is computed above.

Step by step

Solved in 5 steps with 7 images