changes in each company in the composition of current assets and current liabilities. Explain. b) Which assets in each company have the most significant investment? Why? c) Are the companies financed primarily with debt or equity? Why

changes in each company in the composition of current assets and current liabilities. Explain. b) Which assets in each company have the most significant investment? Why? c) Are the companies financed primarily with debt or equity? Why

Chapter1: Financial Statements And Business Decisions

Section: Chapter Questions

Problem 1Q

Related questions

Question

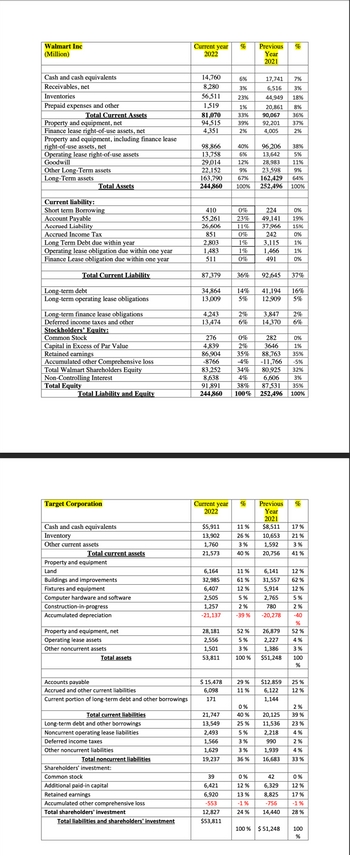

A) Comment on any significant changes in each company in the composition of current assets and current liabilities. Explain.

b) Which assets in each company have the most significant investment? Why?

c) Are the companies financed primarily with debt or equity? Why?

Transcribed Image Text:Walmart Inc

(Million)

Cash and cash equivalents

Receivables, net

Inventories

Prepaid expenses and other

Total Current Assets

Property and equipment, net

Finance lease right-of-use assets, net

Property and equipment, including finance lease

right-of-use assets, net

Operating lease right-of-use assets

Goodwill

Other Long-Term assets

Long-Term assets

Total Assets

Current liability:

Short term Borrowing

Account Payable

Accrued Liability

Accrued Income Tax

Long Term Debt due within year

Operating lease obligation due within one year

Finance Lease obligation due within one year

Total Current Liability

Long-term debt

Long-term operating lease obligations

Long-term finance lease obligations

Deferred income taxes and other

Stockholders' Equity:

Common Stock

Capital in Excess of Par Value

Retained earnings

Accumulated other Comprehensive loss

Total Walmart Shareholders Equity

Non-Controlling Interest

Total Equity

Total Liability and Equity

Target Corporation

Cash and cash equivalents

Inventory

Other current assets

Total current assets

Property and equipment

Land

Buildings and improvements

Fixtures and equipment

Computer hardware and software

Construction-in-progress

Accumulated depreciation

Property and equipment, net

Operating lease assets

Other noncurrent assets

Total assets

Accounts payable

Accrued and other current liabilities

Current portion of long-term debt and other borrowings

Total current liabilities

Long-term debt and other borrowings

Noncurrent operating lease liabilities

Deferred income taxes

Other noncurrent liabilities

Total noncurrent liabilities

Shareholders' investment:

Common stock

Additional paid-in capital

Retained earnings

Accumulated other comprehensive loss

Total shareholders' investment

Total liabilities and shareholders' investment

Current year

2022

14,760

8,280

56,511

1,519

81,070

94,515

4.351

98,866

13,758

29,014

22,152

163.790

244,860

410

55,261

26,606

851

2,803

1,483

511

87,379

34,864

13,009

4,243

13,474

276

4,839

86,904

-8766

83.252

8,638

91,891

244,860

$5,911

13,902

1,760

21,573

6,164

32,985

6,407

2,505

1,257

-21,137

28,181

2,556

1,501

53,811

$ 15,478

6,098

171

21,747

13,549

2,493

1,566

1,629

19,237

39

6,421

%

6,920

-553

12,827

$53,811

6%

3%

17,741

6,516

44,949

23%

1%

33% 90,067

20,861

39%

92,201

4,005

2%

40%

6%

12%

96,206

13,642

28,983

9% 23,598

67% 162,429

252,496

100%

0%

224

23% 49,141

11% 37,966

0%

242

1%

1%

0%

14%

5%

Previous %

Year

2021

36% 92,645

2%

6%

52%

5%

3%

100 %

3,115

1,466

491

29%

11%

Current year % Previous %

2022

Year

2021

11%

$8,511

26% 10,653

3%

1,592

40 %

20,756

0%

40 %

25%

5%

3%

3%

36%

3,847

14,370

HHL

0%

282

2%

3646

35% 88,763

-4% -11,766

34% 80.925

4% 6,606

38% 87,531

35%

100% 252,496 100%

41,194 16%

12,909

5%

SAN

26,879

2,227

1,386

$51,248

▬▬▬▬

7%

3%

18%

11%

6,141

12%

61%

31,557

62%

12% 5,914 12%

5%

2,765 5%

780

2%

2%

-39%

-20,278 -40

-40

8%

36%

37%

2%

38%

5%

11%

9%

64%

100%

0%

42

12% 6,329

13 %

-1%

24%

8,825

-756

14,440

0%

19%

15%

0%

1%

1%

0%

37%

100% $51,248

2%

6%

HH

▬▬▬▬▬▬▬▬

0%

1%

35%

-5%

32%

3%

17%

21%

3%

41%

$12,859

25 %

6,122 12%

1,144

%

79

52 %

2%

20,125 39%

11,536 23%

4%

2%

2,218

990

1,939 4%

16,683 33%

4%

3%

100

%

0%

12%

17%

-1%

28%

100

%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

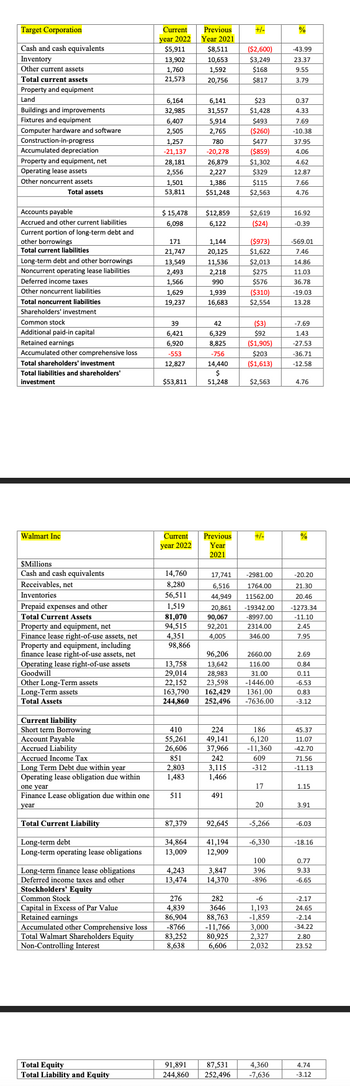

Are the companies financed primarily with debt or equity? Why?

Solution

Follow-up Question

D) Is the debt primarily short-term or long-term? Why?

E ) Compare the

F) Comment on any significant changes in each company in assets and liabilities. Explain

Transcribed Image Text:Walmart Inc

(Million)

Cash and cash equivalents

Receivables, net

Inventories

Prepaid expenses and other

Total Current Assets

Property and equipment, net

Finance lease right-of-use assets, net

Property and equipment, including finance lease

right-of-use assets, net

Operating lease right-of-use assets

Goodwill

Other Long-Term assets

Long-Term assets

Total Assets

Current liability:

Short term Borrowing

Account Payable

Accrued Liability

Accrued Income Tax

Long Term Debt due within year

Operating lease obligation due within one year

Finance Lease obligation due within one year

Total Current Liability

Long-term debt

Long-term operating lease obligations

Long-term finance lease obligations

Deferred income taxes and other

Stockholders' Equity:

Common Stock

Capital in Excess of Par Value

Retained earnings

Accumulated other Comprehensive loss

Total Walmart Shareholders Equity

Non-Controlling Interest

Total Equity

Total Liability and Equity

Target Corporation

Cash and cash equivalents

Inventory

Other current assets

Total current assets

Property and equipment

Land

Buildings and improvements

Fixtures and equipment

Computer hardware and software

Construction-in-progress

Accumulated depreciation

Property and equipment, net

Operating lease assets

Other noncurrent assets

Total assets

Accounts payable

Accrued and other current liabilities

Current portion of long-term debt and other borrowings

Total current liabilities

Long-term debt and other borrowings

Noncurrent operating lease liabilities

Deferred income taxes

Other noncurrent liabilities

Total noncurrent liabilities

Shareholders' investment:

Common stock

Additional paid-in capital

Retained earnings

Accumulated other comprehensive loss

Total shareholders' investment

Total liabilities and shareholders' investment

Current year

2022

14,760

8,280

56,511

1,519

81,070

94,515

4.351

98,866

13,758

29,014

22,152

163.790

244,860

410

55,261

26,606

851

2,803

1,483

511

87,379

34,864

13,009

4,243

13,474

276

4,839

86,904

-8766

83.252

8,638

91,891

244,860

$5,911

13,902

1,760

21,573

6,164

32,985

6,407

2,505

1,257

-21,137

28,181

2,556

1,501

53,811

$ 15,478

6,098

171

21,747

13,549

2,493

1,566

1,629

19,237

39

6,421

%

6,920

-553

12,827

$53,811

6%

3%

17,741

6,516

44,949

23%

1%

33% 90,067

20,861

39%

92,201

4,005

2%

40%

6%

12%

96,206

13,642

28,983

9% 23,598

67% 162,429

252,496

100%

0%

224

23% 49,141

11% 37,966

0%

242

1%

1%

0%

14%

5%

Previous %

Year

2021

36% 92,645

2%

6%

52%

5%

3%

100 %

3,115

1,466

491

29%

11%

Current year % Previous %

2022

Year

2021

11%

$8,511

26% 10,653

3%

1,592

40 %

20,756

0%

40 %

25%

5%

3%

3%

36%

3,847

14,370

HHL

0%

282

2%

3646

35% 88,763

-4% -11,766

34% 80.925

4% 6,606

38% 87,531

35%

100% 252,496 100%

41,194 16%

12,909

5%

SAN

26,879

2,227

1,386

$51,248

▬▬▬▬

7%

3%

18%

11%

6,141

12%

61%

31,557

62%

12% 5,914 12%

5%

2,765 5%

780

2%

2%

-39%

-20,278 -40

-40

8%

36%

37%

2%

38%

5%

11%

9%

64%

100%

0%

42

12% 6,329

13 %

-1%

24%

8,825

-756

14,440

0%

19%

15%

0%

1%

1%

0%

37%

100% $51,248

2%

6%

HH

▬▬▬▬▬▬▬▬

0%

1%

35%

-5%

32%

3%

17%

21%

3%

41%

$12,859

25 %

6,122 12%

1,144

%

79

52 %

2%

20,125 39%

11,536 23%

4%

2%

2,218

990

1,939 4%

16,683 33%

4%

3%

100

%

0%

12%

17%

-1%

28%

100

%

Transcribed Image Text:Target Corporation

Cash and cash equivalents

Inventory

Other current assets

Total current assets

Property and equipment

Land

Buildings and improvements

Fixtures and equipment

Computer hardware and software

Construction-in-progress

Accumulated depreciation

Property and equipment, net

Operating lease assets

Other noncurrent assets

Total assets

Accounts payable

Accrued and other current liabilities

Current portion of long-term debt and

other borrowings

Total current liabilities

Long-term debt and other borrowings

Noncurrent operating lease liabilities

Deferred income taxes.

Other noncurrent liabilities

Total noncurrent liabilities

Shareholders' investment

Common stock

Additional paid-in capital

Retained earnings

Accumulated other comprehensive loss

Total shareholders' investment

Total liabilities and shareholders'

investment

Walmart Inc

$Millions

Cash and cash equivalents

Receivables, net

Inventories

Prepaid expenses and other

Total Current Assets

Property and equipment, net

Finance lease right-of-use assets, net

Property and equipment, including

finance lease right-of-use assets, net

Operating lease right-of-use assets

Goodwill

Other Long-Term assets

Long-Term assets

Total Assets

Current liability

Short term Borrowing

Account Payable

Accrued Liability

Accrued Income Tax

Long Term Debt due within year

Operating lease obligation due within

one year

Finance Lease obligation due within one

year

Total Current Liability

$ 15,478

6,098

171

21,747

Fili

13,549

2,493

1,566

1,629

19,237

Long-term debt

Long-term operating lease obligations

Long-term finance lease obligations

Deferred income taxes and other

Stockholders' Equity

Common Stock

Capital in Excess of Par Value

Retained earnings

Accumulated other Comprehensive loss

Total Walmart Shareholders Equity

Non-Controlling Interest

Current Previous

year 2022

Year 2021

Total Equity

Total Liability and Equity

$5,911

13,902

1,760

21,573

6,164

32,985

6,407

2,505

1,257

-21,137

wy

28,181

2,556

1,501

53,811

39

6,421

6,920

-553

12.827

$53,811

Current

year 2022

14,760

8,280

56,511

1,519

81,070

94,515

4,351

98,866

410

55,261

26,606

851

2,803

1,483

511

HT

87,379

34,864

13,009

4,243

13,474

276

4,839

86.904

$8,511

10,653

1,592

20,756

-8766

83,252

8,638

6,141

31,557

5,914

2,765

780

-20,278

26,879

2,227

1,386

$51,248

$12,859

6,122

1,144

20,125

11,536

2,218

990

1.939

16,683

96,206

13,758

13,642

29,014

28,983

22,152

23,598

163,790 162,429

244,860

42

6,329

8,825

-756

14,440

$

51,248

Previous

Year

2021

90,067

92,201

4,005

3,115

1,466

491

92,645

+/-

41,194

12,909

($2,600)

$3,249

$168

$817

3,847

14,370

$23

$1,428

282

3646

88.763

$493

($260)

$477

($859)

$1,302

$329

$115

$2,563

-11,766

80,925

6,606

$2,619

($24)

($973)

17,741 -2981.00

6,516

44,949

20,861 -19342.00

-8997.00

2314.00

346.00

$1,622

$2,013

$275

$576

2660.00

116.00

31.00

-1446.00

1361.00

252,496 -7636.00

($310)

$2,554

224

186

49,141

6,120

37,966 -11,360

242

609

-312

($3)

$92

($1,905)

$203

($1,613)

$2,563

+/-

1764.00

11562.00

17

20

-5,266

-6,330

100

396

-896

-6

1,193

-1,859

3,000

2,327

2,032

%

4,360

91,891 87,531

244,860 252,496 -7,636

-43.99

23.37

9.55

3.79

0.37

4.33

7.69

-10.38

37.95

4.06

4.62

12.87

7.66

4.76

16.92

-0.39

-569.01

7.46

14.86

11.03

36.78

-19.03

13.28

-7.69

1.43

-27.53

-36.71

-12.58

4.76

%

-20.20

21.30

20.46

-1273.34

-11.10

2.45

7.95

2.69

0.84

0.11

-6.53

0.83

-3.12

45.37

11.07

-42.70

71.56

-11.13

1.15

3.91

-6.03

-18.16

0.77

9.33

-6.65

-2.17

24.65

-2.14

-34.22

2.80

23.52

4.74

-3.12

Solution

Recommended textbooks for you

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis…

Accounting

ISBN:

9780134475585

Author:

Srikant M. Datar, Madhav V. Rajan

Publisher:

PEARSON

Intermediate Accounting

Accounting

ISBN:

9781259722660

Author:

J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:

McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:

9781259726705

Author:

John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:

McGraw-Hill Education