and use your results to compare the funds with respect to risk. Which fund is and Fund 3 is < Prev 18 of 20 Next >

and use your results to compare the funds with respect to risk. Which fund is and Fund 3 is < Prev 18 of 20 Next >

MATLAB: An Introduction with Applications

6th Edition

ISBN:9781119256830

Author:Amos Gilat

Publisher:Amos Gilat

Chapter1: Starting With Matlab

Section: Chapter Questions

Problem 1P

Related questions

Question

Transcribed Image Text:ab

s lock

esc

2.

00:42:35

Mc

Graw

(c) Calculate the coefficient of variation for each fund, and use your results to compare the funds with respect to risk. Which fund is

riskiest? (Round your answers to 2 decimal places.)

!

1

Fund 1: Coefficient of Variation=

Fund 2: Coefficient of Variation =

Fund 3: Coefficient of Variation=

Fund 1 is

←

Q

A

U

2

N

W

S

#3

3

Fund 2 is

с

X

E

H

%

D

$

4

R

C

and Fund 3 is

%

5

< Prev

G Search or type URL

LL

MacBook Pro

T

V

18 of 20

^

< 6

G

Y

&

7

B

Next >

H

U

8

→

J

N

9

1

Transcribed Image Text:18

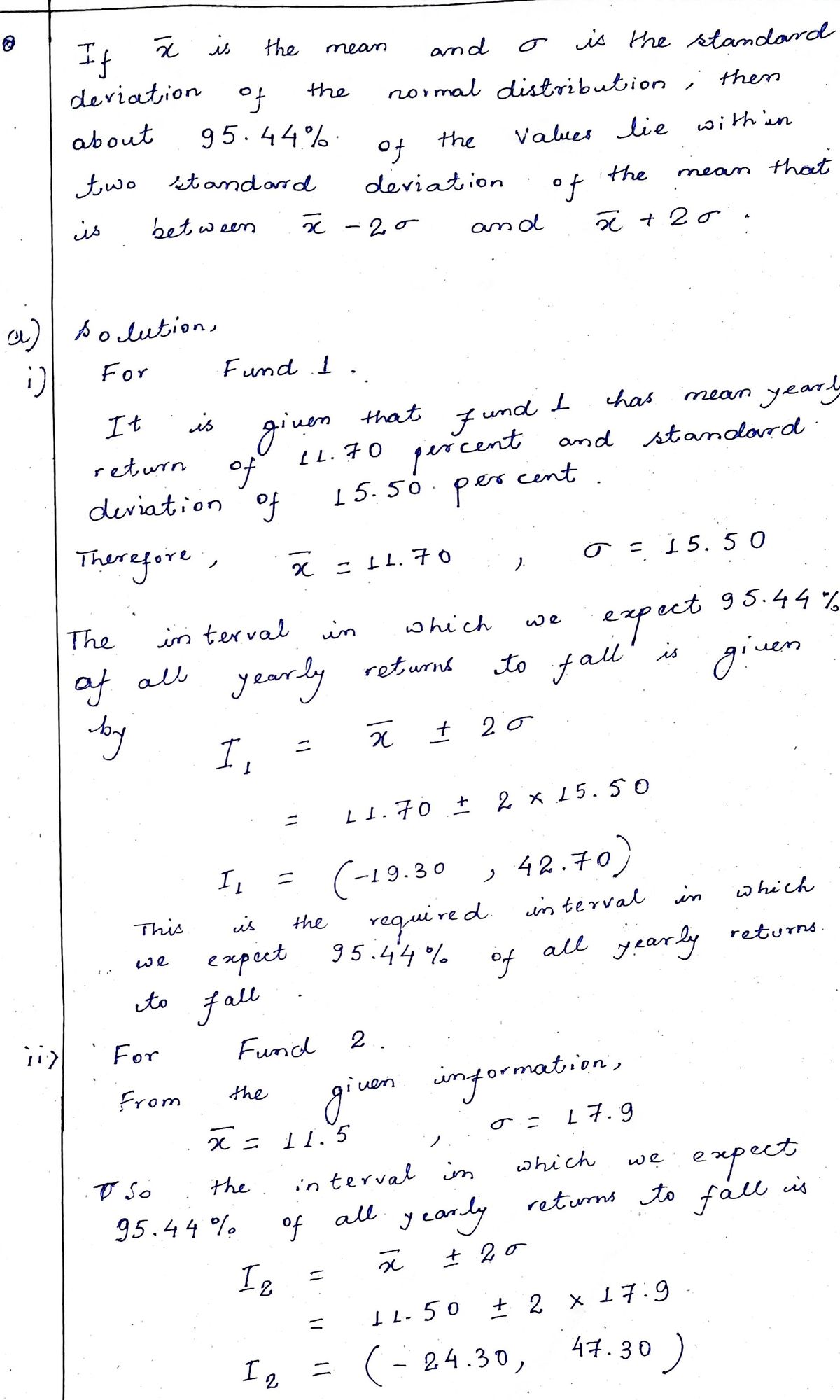

Consider three stock funds, which we will call Stock Funds 1, 2, and 3. Suppose that Stock Fund 1 has a mean yearly return of 11.70

percent with a standard deviation of 15.50 percent; Stock Fund 2 has a mean yearly return of 11.50 percent with a standard deviation of

17.90 percent, and Stock Fund 3 has a mean yearly return of 25.70 percent with a standard deviation of 7.00 percent.

esc

00:42:45

Mc

Graw

Hill

(a) For each fund, find an interval in which you would expect 95.44 percent of all yearly returns to fall. Assume returns are normally

distributed. (Round your answers to 2 decimal places. Negative amounts should be indicated by a minus sign.)

Fund 1:

Fund 2:

Fund 3:

. د

1

Fund 1 has the

Fund 2 has the

Fund 3 has the

it

i

[

(b) Using the intervals you computed in part a, compare the three funds with respect to average yearly returns and with respect to

variability of returns.

Q

(3.80)

(6.40)

18.70

lowest

lowest

highest

Fund 1: Coefficient of Variation =

2

(c) Calculate the coefficient of variation for each fund, and use your results to compare the funds with respect to risk. Which fund is

riskiest? (Round your answers to 2 decimal places.)

W

average return and the

average return and the

average return and the

27.201

29.401

32.701

#3

с

E

D

%

$

4

R

L

variability.

variability.

variability.

%

5

< Prev

G Search or type URL

T

MacBook Pro

^

18 of 20

6

C

&

7

Next >

L

* 00

8

Y U

+

(

(

-

9

Expert Solution

Step 1

Step by step

Solved in 4 steps with 4 images

Recommended textbooks for you

MATLAB: An Introduction with Applications

Statistics

ISBN:

9781119256830

Author:

Amos Gilat

Publisher:

John Wiley & Sons Inc

Probability and Statistics for Engineering and th…

Statistics

ISBN:

9781305251809

Author:

Jay L. Devore

Publisher:

Cengage Learning

Statistics for The Behavioral Sciences (MindTap C…

Statistics

ISBN:

9781305504912

Author:

Frederick J Gravetter, Larry B. Wallnau

Publisher:

Cengage Learning

MATLAB: An Introduction with Applications

Statistics

ISBN:

9781119256830

Author:

Amos Gilat

Publisher:

John Wiley & Sons Inc

Probability and Statistics for Engineering and th…

Statistics

ISBN:

9781305251809

Author:

Jay L. Devore

Publisher:

Cengage Learning

Statistics for The Behavioral Sciences (MindTap C…

Statistics

ISBN:

9781305504912

Author:

Frederick J Gravetter, Larry B. Wallnau

Publisher:

Cengage Learning

Elementary Statistics: Picturing the World (7th E…

Statistics

ISBN:

9780134683416

Author:

Ron Larson, Betsy Farber

Publisher:

PEARSON

The Basic Practice of Statistics

Statistics

ISBN:

9781319042578

Author:

David S. Moore, William I. Notz, Michael A. Fligner

Publisher:

W. H. Freeman

Introduction to the Practice of Statistics

Statistics

ISBN:

9781319013387

Author:

David S. Moore, George P. McCabe, Bruce A. Craig

Publisher:

W. H. Freeman