An n vestment firm estimates that the Value port folio af terA years s A m lhon do llars where ACH) = 500 In (2t+10) a. How long, will take for the account to double its intidl valve? b.How long wllt take for the accaunt to friple its initial valve

An n vestment firm estimates that the Value port folio af terA years s A m lhon do llars where ACH) = 500 In (2t+10) a. How long, will take for the account to double its intidl valve? b.How long wllt take for the accaunt to friple its initial valve

Calculus: Early Transcendentals

8th Edition

ISBN:9781285741550

Author:James Stewart

Publisher:James Stewart

Chapter1: Functions And Models

Section: Chapter Questions

Problem 1RCC: (a) What is a function? What are its domain and range? (b) What is the graph of a function? (c) How...

Related questions

Question

100%

![**Transcription for Educational Website**

---

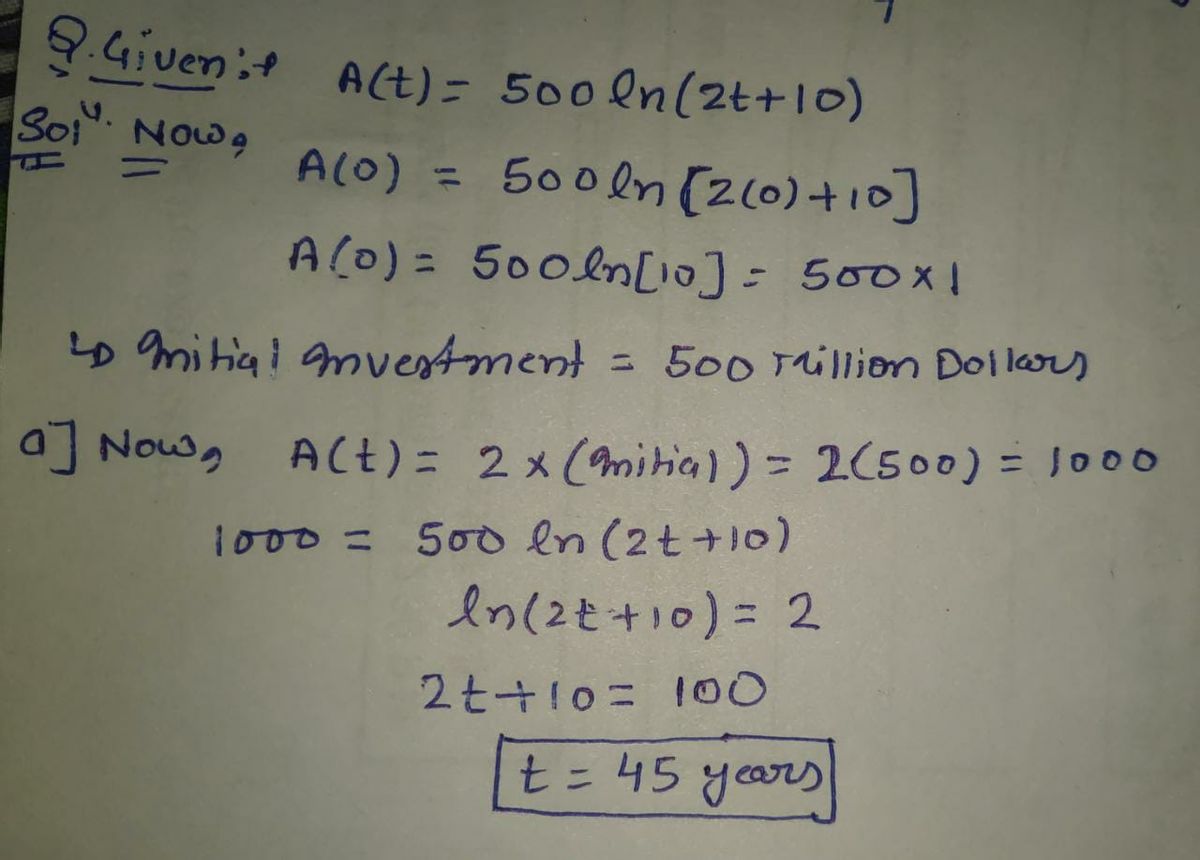

An investment firm estimates that the value of its portfolio after \( t \) years is \( A \) million dollars, where

\[ A(t) = 500 \ln(2t + 10) \]

**a. How long will it take for the account to double its initial value?**

**b. How long will it take for the account to triple its initial value?**

---

**Explanation:**

The equation \( A(t) = 500 \ln(2t + 10) \) represents the estimated growth of the investment portfolio over time. Here, \( A(t) \) denotes the amount in millions of dollars, \( t \) is the time in years, and \(\ln\) is the natural logarithm.

The tasks involve using this formula to determine the amount of time needed to double and triple the initial value of the portfolio.](/v2/_next/image?url=https%3A%2F%2Fcontent.bartleby.com%2Fqna-images%2Fquestion%2F57fb845d-846a-46ba-b8b8-1eb11c40b14f%2Fdc00c540-7f7d-4543-8afc-02c562cf930c%2Fr5tq47j_processed.jpeg&w=3840&q=75)

Transcribed Image Text:**Transcription for Educational Website**

---

An investment firm estimates that the value of its portfolio after \( t \) years is \( A \) million dollars, where

\[ A(t) = 500 \ln(2t + 10) \]

**a. How long will it take for the account to double its initial value?**

**b. How long will it take for the account to triple its initial value?**

---

**Explanation:**

The equation \( A(t) = 500 \ln(2t + 10) \) represents the estimated growth of the investment portfolio over time. Here, \( A(t) \) denotes the amount in millions of dollars, \( t \) is the time in years, and \(\ln\) is the natural logarithm.

The tasks involve using this formula to determine the amount of time needed to double and triple the initial value of the portfolio.

Expert Solution

Step 1

Step by step

Solved in 2 steps with 2 images

Recommended textbooks for you

Calculus: Early Transcendentals

Calculus

ISBN:

9781285741550

Author:

James Stewart

Publisher:

Cengage Learning

Thomas' Calculus (14th Edition)

Calculus

ISBN:

9780134438986

Author:

Joel R. Hass, Christopher E. Heil, Maurice D. Weir

Publisher:

PEARSON

Calculus: Early Transcendentals (3rd Edition)

Calculus

ISBN:

9780134763644

Author:

William L. Briggs, Lyle Cochran, Bernard Gillett, Eric Schulz

Publisher:

PEARSON

Calculus: Early Transcendentals

Calculus

ISBN:

9781285741550

Author:

James Stewart

Publisher:

Cengage Learning

Thomas' Calculus (14th Edition)

Calculus

ISBN:

9780134438986

Author:

Joel R. Hass, Christopher E. Heil, Maurice D. Weir

Publisher:

PEARSON

Calculus: Early Transcendentals (3rd Edition)

Calculus

ISBN:

9780134763644

Author:

William L. Briggs, Lyle Cochran, Bernard Gillett, Eric Schulz

Publisher:

PEARSON

Calculus: Early Transcendentals

Calculus

ISBN:

9781319050740

Author:

Jon Rogawski, Colin Adams, Robert Franzosa

Publisher:

W. H. Freeman

Calculus: Early Transcendental Functions

Calculus

ISBN:

9781337552516

Author:

Ron Larson, Bruce H. Edwards

Publisher:

Cengage Learning