An investor is attempting to decide between the purchase of a tax-free municipal bond or a corporate bond. She is in the 32% tax bracket (rate). A municipal bond yields 2.2% interest and a corporate bond yields 3.1% interest. Which should she purchase? Please state the reason.

An investor is attempting to decide between the purchase of a tax-free municipal bond or a corporate bond. She is in the 32% tax bracket (rate). A municipal bond yields 2.2% interest and a corporate bond yields 3.1% interest. Which should she purchase? Please state the reason.

The details given are:

Tax rate @32%

The yield of Municipal Bond: 2.2%

Corporate Bonds: 3.1%

Municipal bonds are issued by a state or central government and hence it is tax-free.

So the after-tax return from municipal bonds is 2.2% itself.

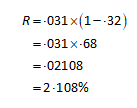

Calculation of After-Tax Return from Corporate Bonds:

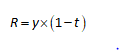

The formula to calculate is,

Whereas,

After-tax return or yield is represented by R

Taxable yield is represented by y

The tax rate is represented by t

Therefore,

After-tax return or yield from corporate bonds is 2.108%.

Step by step

Solved in 2 steps with 2 images