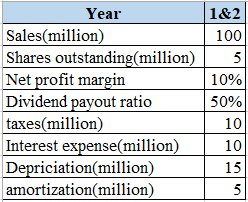

An investor has estimated that next year's sales for Pagoda Hotel will be RM100 million. Pagoda Hotel has 5 million shares outstanding. It generates a net profit margin of about 10%, and has a dividend pay-out ratio of 50%. Interest expense is RM10 million, taxes RM10 million, depreciation RM15 million, and amortisation about RM5 million. All amounts are expected to remain the same next year. Required: (f) The expected price of the stock two years from now, if you the stock is trading at about 8 times its projected cash flow per share. Determine whether the stock is undervalued or overvalued (assume that the market price of the share two years from now is RM50 per share).

An investor has estimated that next year's sales for Pagoda Hotel will be RM100 million. Pagoda Hotel has 5 million shares outstanding. It generates a net profit margin of about 10%, and has a dividend pay-out ratio of 50%. Interest expense is RM10 million, taxes RM10 million, depreciation RM15 million, and amortisation about RM5 million. All amounts are expected to remain the same next year. Required: (f) The expected price of the stock two years from now, if you the stock is trading at about 8 times its projected cash flow per share. Determine whether the stock is undervalued or overvalued (assume that the market price of the share two years from now is RM50 per share).

Essentials Of Investments

11th Edition

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Chapter1: Investments: Background And Issues

Section: Chapter Questions

Problem 1PS

Related questions

Question

Please help me

Transcribed Image Text:An investor has estimated that next year's sales for Pagoda Hotel will be RM100 million. Pagoda

Hotel has 5 million shares outstanding. It generates a net profit margin of about 10%, and has a

dividend pay-out ratio of 50%. Interest expense is RM10 million, taxes RM10 million, depreciation

RM15 million, and amortisation about RM5 million. All amounts are expected to remain the same

next year.

Required:

(f) The expected price of the stock two years from now, if you the stock is trading at about 8

times its projected cash flow per share. Determine whether the stock is undervalued or

overvalued (assume that the market price of the share two years from now is RM50 per

share).

Expert Solution

Given Details:

To find:

- Share price after two years.

Step by step

Solved in 2 steps with 3 images

Recommended textbooks for you

Essentials Of Investments

Finance

ISBN:

9781260013924

Author:

Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:

Mcgraw-hill Education,

Essentials Of Investments

Finance

ISBN:

9781260013924

Author:

Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:

Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:

9780134897264

Author:

KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:

Pearson,

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i…

Finance

ISBN:

9780077861759

Author:

Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:

McGraw-Hill Education