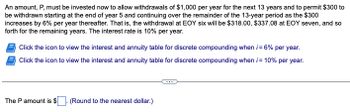

An amount, P, must be invested now to allow withdrawals of $1,000 per year for the next 13 years and to permit $300 to be withdrawn starting at the end of year 5 and continuing over the remainder of the 13-year period as the $300 increases by 6% per year thereafter. That is, the withdrawal at EOY six will be $318.00, $337.08 at EOY seven, and so forth for the remaining years. The interest rate is 10% per year. Click the icon to view the interest and annuity table for discrete compounding when i= 6% per year. Click the icon to view the interest and annuity table for discrete compounding when i = 10% per year. The P amount is $ (Round to the nearest dollar.)

An amount, P, must be invested now to allow withdrawals of $1,000 per year for the next 13 years and to permit $300 to be withdrawn starting at the end of year 5 and continuing over the remainder of the 13-year period as the $300 increases by 6% per year thereafter. That is, the withdrawal at EOY six will be $318.00, $337.08 at EOY seven, and so forth for the remaining years. The interest rate is 10% per year. Click the icon to view the interest and annuity table for discrete compounding when i= 6% per year. Click the icon to view the interest and annuity table for discrete compounding when i = 10% per year. The P amount is $ (Round to the nearest dollar.)

Oh no! Our experts couldn't answer your question.

Don't worry! We won't leave you hanging. Plus, we're giving you back one question for the inconvenience.

Submit your question and receive a step-by-step explanation from our experts in as fast as 30 minutes.

You have no more questions left.

Message from our expert:

Thank you for taking the time to provide feedback! Please let us know more here so we will not miss it. We have credited a question to your account.

Your Question:

Transcribed Image Text:An amount, P, must be invested now to allow withdrawals of $1,000 per year for the next 13 years and to permit $300 to

be withdrawn starting at the end of year 5 and continuing over the remainder of the 13-year period as the $300

increases by 6% per year thereafter. That is, the withdrawal at EOY six will be $318.00, $337.08 at EOY seven, and so

forth for the remaining years. The interest rate is 10% per year.

Click the icon to view the interest and annuity table for discrete compounding when i= 6% per year.

Click the icon to view the interest and annuity table for discrete compounding when i = 10% per year.

The P amount is $

(Round to the nearest dollar.)

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning