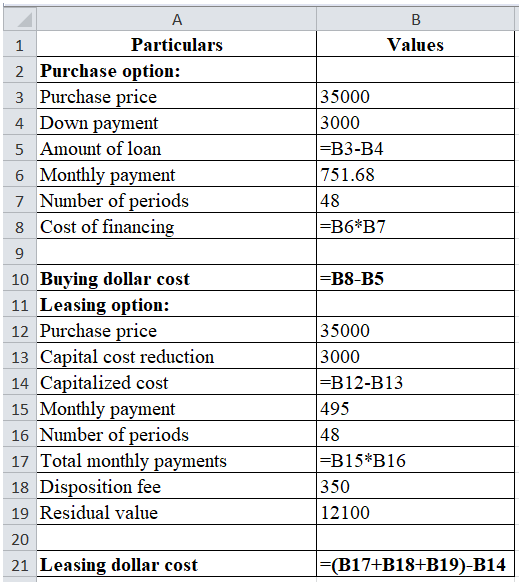

Amanda must decide to buy or lease a car that she has selected. She has negoiated a purchase price of $35,000 and can borrow money from her credit union by putting $3,000 down and paying $751.68 per month for 48 months at 6% APR. Alternatively, she could lease the car for 48 months at $495 per month by paying $3,000 capitalized cost reduction and a $350 dispostition fee on the car whic is project to have a residual value of $12,100 at the end of the lease. 1. What is the buying dollar cost? 2. What is the leasing dollar cost?

Amanda must decide to buy or lease a car that she has selected. She has negoiated a purchase price of $35,000 and can borrow money from her credit union by putting $3,000 down and paying $751.68 per month for 48 months at 6% APR.

Alternatively, she could lease the car for 48 months at $495 per month by paying $3,000 capitalized cost reduction and a $350 dispostition fee on the car whic is project to have a residual value of $12,100 at the end of the lease.

1. What is the buying dollar cost?

2. What is the leasing dollar cost?

Given information:

Purchase price is $35,000

Down payment $3,000

Paying monthly $751.68 for 48 months

APR is 6%

Lease:

Monthly payment of $495 for 48 months,

Capitalized cost $3,000

Disposition fee $350

Residual value $12,100

Calculation buying dollar cost and leasing dollar cost:

Excel workings:

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images