Aloan stock has been issued by a company with a coupon of6% per annum payable half-yearlyin arrearsand redeemable at 115% at any duration from20to 25 yearsat the option of the company.An investor who is liable to capital gains tax (CGT) at 30% and income tax at 40% bought the stock at issue at a price givingthe investor a minimum net yield of 7% per annum effective.Fifteenyears later, the investor sold the stock to a pension fundthat is not liable to tax, at a price which gave the fund a minimum gross yield of 5% per annum. (a)Calculate the price paid by the investorwhen purchasing the stock. (b)Calculate the sale price of the stock. (c)Calculate, to the nearest 1%, the net effective annual rate of return achieved by the investor.

Aloan stock has been issued by a company with a coupon of6% per annum payable half-yearlyin arrearsand redeemable at 115% at any duration from20to 25 yearsat the option of the company.An investor who is liable to

(a)Calculate the price paid by the investorwhen purchasing the stock.

(b)Calculate the sale price of the stock.

(c)Calculate, to the nearest 1%, the net effective annual

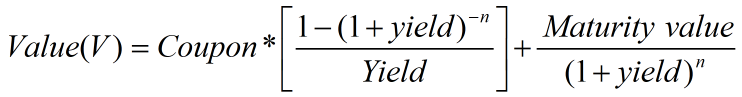

The question is based on the concept valuation of bond with a semiannual coupon payment. The valuation of bond with below equation as,

Given Data ,

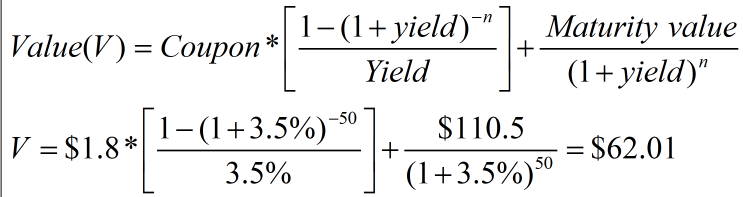

Coupon rate = 6% (annual) = 3% semiannual

Coupon 3%*100 = 3

Income tax = 40%

Net coupon = 3* (1-40%) = 1.8

Maturity value = 115

Capital gain tax = 30%

Net Maturity value = 115 – [(115-100)*30%]=110.5

Yield = 7% (annual) = 3.5% (semiannual)

Maturity = 25 years = 25*2 = 50 payments

Answer a) Purchase price of stock

Step by step

Solved in 3 steps with 3 images