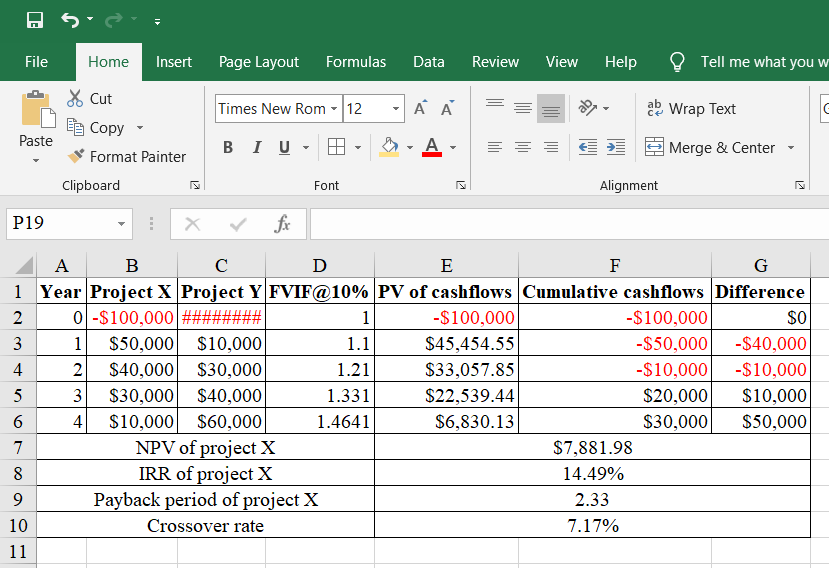

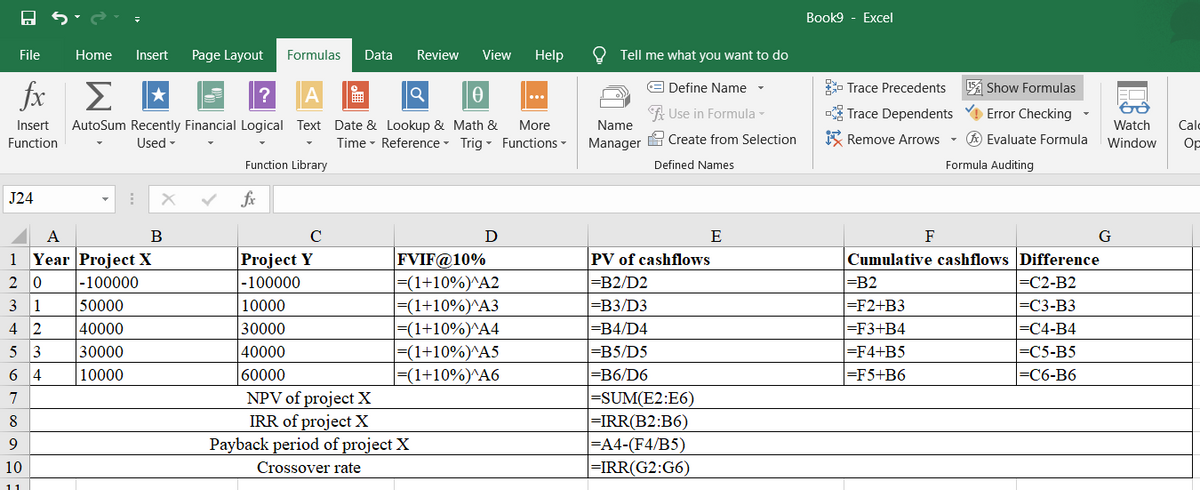

The two projects are as follows. Discount rate = 10%.

Project X Project Y

Year Cash-Flow Cash-Flow

0 -$100,000 -$100,000

1 50,000 10,000

2 40,000 30,000

3. 30,000 40,000

4 10,000 60,000

Calculate the

- $6,032.99

- $4,239.20

- $7,881.98

- $4,917.70

Calculate

- 19%

- 49%

- 79%

- 59%

Calculate the payback period of project X

- 33 years

- 33 years

- 33 years

- 33 years

Calculate the crossover rate.

- 93%

- 58%

- 00%

- 17%

It refers to the long term investment decisions that has been taken by the top management of a company and that are irreversible in nature. These decisions require investment of large amount of the company’s cash.

Step by step

Solved in 3 steps with 2 images