Accounting Question

Accounting Equation:

It is also known as the basic accounting equation, which provides the foundation for all the accounting systems. The entire double entry system in accounting is based on an account equation. The accounting equation is presented as under:

Assets = Liabilities + Equity

For corporations, equity stands for stockholders' equity, and for a sole proprietorship, equity stands for owners' equity. This equation reflects that all the company's assets are acquired by either debt or equity financing. The accounting equation offers a simple way to understand how the three of them are related to each other.

Assets are the company's resources, things the company owns, like cash, equipment, land, buildings, receivables, investments, etc. Liabilities are the company's obligations, things companies owe, such as accounts payable, note payable, salary payable. Equity represents the amount of money invested by the owner or stockholder of the institution, it also considers the cumulative net income or loss of the company which has not been withdrawn or distributed by the owner.

Owners' Equity = Contributed Capital + Retained Earnings

Retained Earnings = Net Income - Dividend

Net Income = Revenue - Expenses

Financial Statements:

It represents a formal record of the financial activities of an entity. These are written reports that quantify the financial strength, performance, and liquidity of the entity. It includes income statements, balance sheet, statement of retained earnings, and cash flow statement.

Let us look into the problem, and calculate the requirements in the following steps.

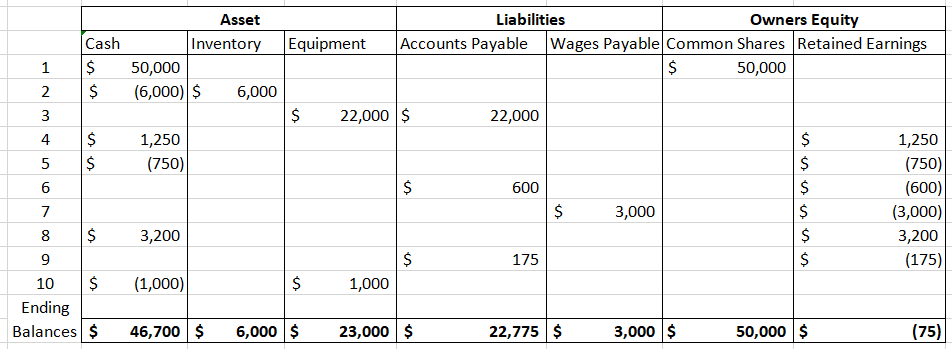

In the given problem, the effects of various transactions have already been recorded as per the accounting equation. We are provided with the entire table, we are required to calculate the ending balances.

The ending balances are calculated by adding all the amounts in each account, and subtracting if there is a negative sign, which means if there is a decrease in the value of the account for any given transaction.

Let us now calculate the ending balances of each account as under:

Therefore, we have computed the ending balances of each account for the information given.

Income Statement:

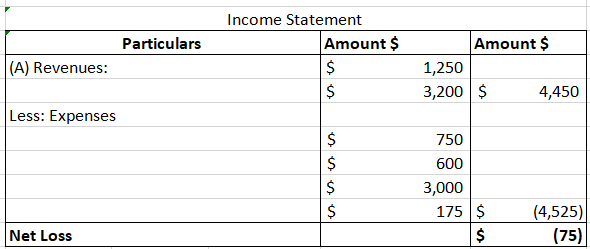

It reports financial performance in terms of profit or loss for a specific period. It is also called the Statement of Profit or Loss. It is computed by subtracting the total expenses incurred by the business organization during a particular accounting period from the total revenues earned.

As explained in the introduction part, in the accounting equation part of Owners' Equity. It includes the money invested in the business as capital, and also the cumulative income which is included in the retained earnings. Therefore, we saw that net income or loss for the accounting period affects the retained earnings account. This net income is calculated as discussed above.

Therefore, for the preparation of the income statement, we will consider the amounts that are affected by the retained earnings account. The amount which is positive is the revenues earned and the amounts which are negative are the expenses incurred during the accounting period.

Therefore, the income statement is prepared as follows:

Therefore, the net loss incurred for the accounting period is $75 and the statement is also prepared as above.

Step by step

Solved in 5 steps with 4 images