In 2020, Ms. Montibon owns a grocery store with gross receipts of P1,375,000. Her cost of sales and operating expenses are P600,000 and P400,000, respectively, and with non-operating income of P100,000.1. What business tax is due to her?2. How much is the income tax due to her?3. How much tax due if she availed the OSD?

In 2020, Ms. Montibon owns a grocery store with gross receipts of P1,375,000. Her cost of sales and operating expenses are P600,000 and P400,000, respectively, and with non-operating income of P100,000.1. What business tax is due to her?2. How much is the income tax due to her?3. How much tax due if she availed the OSD?

Chapter1: Financial Statements And Business Decisions

Section: Chapter Questions

Problem 1Q

Related questions

Question

In 2020, Ms. Montibon owns a grocery store with gross receipts of P1,375,000. Her cost of sales and operating expenses are P600,000 and P400,000, respectively, and with non-operating income of P100,000.

1. What business tax is due to her?

2. How much is the income tax due to her?

3. How much tax due if she availed the OSD?

Expert Solution

Provision

- VAT rate (Business Tax) in Philippines currently stands at 12% and is chargeable on Gross Selling Price on Goods and Services.

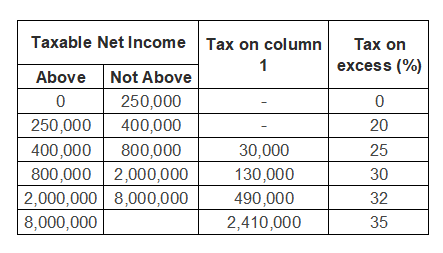

- Income Tax can be paid either at Graduated Tax slabs on Net Taxable Income

- A maximum of 40% of their gross sales or gross receipts shall be allowed as deduction, instead of itemized deduction

Slab rate to compute income tax due are as follows

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis…

Accounting

ISBN:

9780134475585

Author:

Srikant M. Datar, Madhav V. Rajan

Publisher:

PEARSON

Intermediate Accounting

Accounting

ISBN:

9781259722660

Author:

J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:

McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:

9781259726705

Author:

John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:

McGraw-Hill Education