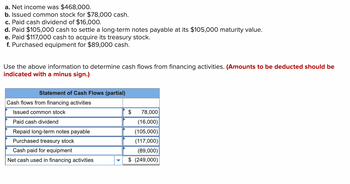

a. Net income was $468,000. b. Issued common stock for $78,000 cash. c. Paid cash dividend of $16,000. d. Paid $105,000 cash to settle a long-term notes payable at its $105,000 maturity value. e. Paid $117,000 cash to acquire its treasury stock. f. Purchased equipment for $89,000 cash. Use the above information to determine cash flows from financing activities. (Amounts to be deducted should be indicated with a minus sign.) Statement of Cash Flows (partial) Cash flows from financing activities

a. Net income was $468,000. b. Issued common stock for $78,000 cash. c. Paid cash dividend of $16,000. d. Paid $105,000 cash to settle a long-term notes payable at its $105,000 maturity value. e. Paid $117,000 cash to acquire its treasury stock. f. Purchased equipment for $89,000 cash. Use the above information to determine cash flows from financing activities. (Amounts to be deducted should be indicated with a minus sign.) Statement of Cash Flows (partial) Cash flows from financing activities

Chapter1: Financial Statements And Business Decisions

Section: Chapter Questions

Problem 1Q

Related questions

Topic Video

Question

Very important please be correct thank you

Transcribed Image Text:**Statement of Cash Flows Analysis**

**Given Information:**

- a. Net income was $468,000.

- b. Issued common stock for $78,000 cash.

- c. Paid cash dividend of $16,000.

- d. Paid $105,000 cash to settle a long-term notes payable at its $105,000 maturity value.

- e. Paid $117,000 cash to acquire its treasury stock.

- f. Purchased equipment for $89,000 cash.

Use the above information to determine cash flows from financing activities. **(Amounts to be deducted should be indicated with a minus sign.)**

**Explanation of Cash Flows from Financing Activities:**

The partial statement of cash flows focuses on financing activities, which include transactions that affect long-term liabilities and equity.

**Components:**

1. **Cash Inflows:**

- **Issued Common Stock:** The business received $78,000 from issuing stock, which is a cash inflow.

2. **Cash Outflows:**

- **Cash Dividends Paid:** The business distributed $16,000 in dividends, reflecting a cash outflow.

- **Settling Long-term Notes Payable:** A cash payment of $105,000 was made to settle a notes payable, indicating a cash outflow.

- **Acquiring Treasury Stock:** The business spent $117,000 to acquire its treasury stock, also a cash outflow.

The table provided is intended to be filled with these amounts, identifying cash inflows with positive numbers and cash outflows with negative amounts, ultimately reflecting the net cash flow from financing activities.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

Is this what it is supposed to be?

Transcribed Image Text:### Financial Transactions Overview

- **Net Income**: $468,000

- **Issuance of Common Stock**: $78,000 cash received.

- **Cash Dividend Paid**: $16,000

- **Repayment of Long-term Notes Payable**: $105,000

- **Purchase of Treasury Stock**: $117,000

- **Equipment Purchase**: $89,000

### Calculating Cash Flows from Financing Activities

The information is utilized to determine the effect on cash flows from financing activities. Amounts to be deducted are indicated with a minus sign.

#### Statement of Cash Flows (Partial)

| Description | Amount ($) |

|------------------------------------------|-------------|

| **Cash flows from financing activities** | |

| Issued common stock | 78,000 |

| Paid cash dividend | (16,000) |

| Repaid long-term notes payable | (105,000) |

| Purchased treasury stock | (117,000) |

| Cash paid for equipment | (89,000) |

| **Net cash used in financing activities**| **(249,000)** |

### Diagram Explanation

The table represents cash flow transactions affecting financing activities, illustrating increases and decreases in cash due to specific financial transactions. Positive amounts indicate cash inflows (e.g., issuing stock), while negative amounts represent cash outflows (e.g., paying dividends, repurchasing stock). The net cash flow from financing activities amounts to a decrease of $249,000.

This breakdown is useful for understanding how different activities impact a company's cash position and for analyzing financial strategies.

Solution

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis…

Accounting

ISBN:

9780134475585

Author:

Srikant M. Datar, Madhav V. Rajan

Publisher:

PEARSON

Intermediate Accounting

Accounting

ISBN:

9781259722660

Author:

J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:

McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:

9781259726705

Author:

John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:

McGraw-Hill Education