a. Define the variables. Be specific with descriptive words. b. Clearly state the constraints (all inequalities) related to the feasible region. c. State the objective function.

a. Define the variables. Be specific with descriptive words. b. Clearly state the constraints (all inequalities) related to the feasible region. c. State the objective function.

MATLAB: An Introduction with Applications

6th Edition

ISBN:9781119256830

Author:Amos Gilat

Publisher:Amos Gilat

Chapter1: Starting With Matlab

Section: Chapter Questions

Problem 1P

Related questions

Question

D. Set up the initial simplex matrix needed to solve the liner programming problem using the simplex method

E. Perform all pivots necessary using row operations to transfer the matrix until the solution is feasible

F. How much should he invest in each to maximize his return, assuming investment returns are as expected

Transcribed Image Text:### Problem 4: Investment Allocation

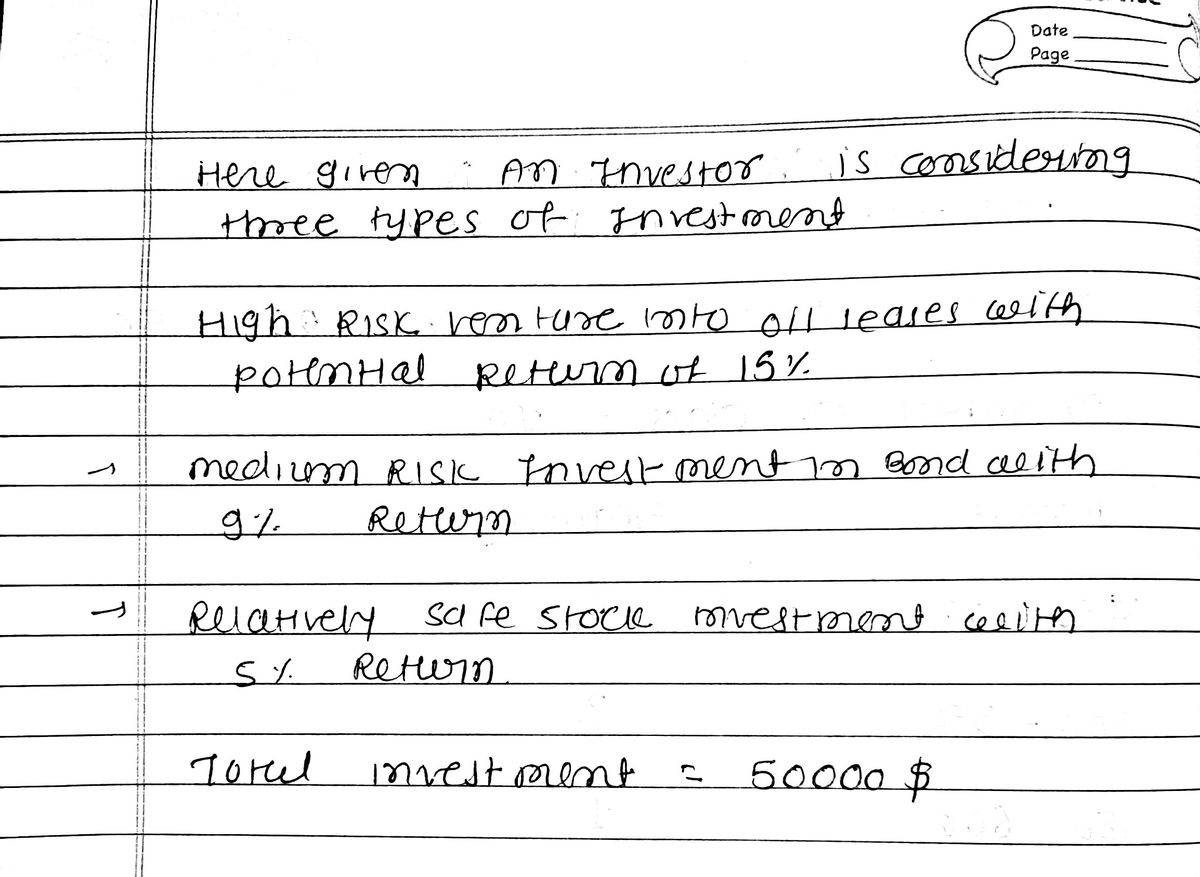

An investor is considering three types of investments:

1. **High-risk venture**: Oil leases with a potential return of 15%.

2. **Medium-risk investment**: Bonds with a 9% return.

3. **Relatively safe investment**: Stock investment with a 5% return.

The investor has $50,000 to invest. Due to risk considerations, the following limitations are imposed:

- Investment in oil leases and bonds is limited to 30%.

- Investment in oil leases and stock is limited to 50%.

**Objective**: Determine the investment strategy that maximizes returns, assuming investment returns are as expected.

#### a. Define the Variables

- \( x = \) Amount invested in oil leases.

- \( y = \) Amount invested in bonds.

- \( z = \) Amount invested in stocks.

#### b. State the Constraints

Clearly define all constraints related to the feasible region using inequalities:

- \( x + y + z = 50,000 \) (Total investment)

- \( x + y \leq 0.3 \times 50,000 \) (Oil leases and bonds investment limit)

- \( x + z \leq 0.5 \times 50,000 \) (Oil leases and stocks investment limit)

- \( x, y, z \geq 0 \) (Non-negativity constraint)

#### c. State the Objective Function

The objective function is the equation that needs to be maximized to find the optimal investment strategy:

- Maximize \( 0.15x + 0.09y + 0.05z \)

This objective function represents the expected return from investments in oil leases, bonds, and stocks, respectively.

Expert Solution

Step 1

AS PER POLICY I HAVE CALCULATED 3 SUBPART

Step by step

Solved in 3 steps with 3 images

Recommended textbooks for you

MATLAB: An Introduction with Applications

Statistics

ISBN:

9781119256830

Author:

Amos Gilat

Publisher:

John Wiley & Sons Inc

Probability and Statistics for Engineering and th…

Statistics

ISBN:

9781305251809

Author:

Jay L. Devore

Publisher:

Cengage Learning

Statistics for The Behavioral Sciences (MindTap C…

Statistics

ISBN:

9781305504912

Author:

Frederick J Gravetter, Larry B. Wallnau

Publisher:

Cengage Learning

MATLAB: An Introduction with Applications

Statistics

ISBN:

9781119256830

Author:

Amos Gilat

Publisher:

John Wiley & Sons Inc

Probability and Statistics for Engineering and th…

Statistics

ISBN:

9781305251809

Author:

Jay L. Devore

Publisher:

Cengage Learning

Statistics for The Behavioral Sciences (MindTap C…

Statistics

ISBN:

9781305504912

Author:

Frederick J Gravetter, Larry B. Wallnau

Publisher:

Cengage Learning

Elementary Statistics: Picturing the World (7th E…

Statistics

ISBN:

9780134683416

Author:

Ron Larson, Betsy Farber

Publisher:

PEARSON

The Basic Practice of Statistics

Statistics

ISBN:

9781319042578

Author:

David S. Moore, William I. Notz, Michael A. Fligner

Publisher:

W. H. Freeman

Introduction to the Practice of Statistics

Statistics

ISBN:

9781319013387

Author:

David S. Moore, George P. McCabe, Bruce A. Craig

Publisher:

W. H. Freeman