2. Assuming when the bond is offered to Sweet, it has a remaining life of 4 years. Sweet required rate of return for her bond investment is 18% p.a.: a. Compute for the value of each bond? How much is the total value of the bonds offered? b. Based on the offered price, what is the bond approximate and exact yield to maturity? c. Would you recommend to Sweet to buy the bonds? Why? Smile Corp. Issued 16% p.a., 10-year Debenture bond, P6,000 face value, interest due every four (4) months. On October 1, Hapi purchased 20 bonds at par. On May 31, she sold 8 bonds to Honey at 105-3/4. Again on September 30, Hapi sold another 6 bonds to Sweet at 96-1/2.

2. Assuming when the bond is offered to Sweet, it has a remaining life of 4 years. Sweet required rate of return for her bond investment is 18% p.a.: a. Compute for the value of each bond? How much is the total value of the bonds offered? b. Based on the offered price, what is the bond approximate and exact yield to maturity? c. Would you recommend to Sweet to buy the bonds? Why? Smile Corp. Issued 16% p.a., 10-year Debenture bond, P6,000 face value, interest due every four (4) months. On October 1, Hapi purchased 20 bonds at par. On May 31, she sold 8 bonds to Honey at 105-3/4. Again on September 30, Hapi sold another 6 bonds to Sweet at 96-1/2.

Oh no! Our experts couldn't answer your question.

Don't worry! We won't leave you hanging. Plus, we're giving you back one question for the inconvenience.

Submit your question and receive a step-by-step explanation from our experts in as fast as 30 minutes.

You have no more questions left.

Message from our expert:

Our experts need more information to provide you with a solution. Please provide complete question text. Please resubmit your question, making sure it's detailed and complete. We've credited a question to your account.

Your Question:

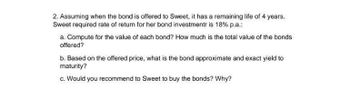

Transcribed Image Text:2. Assuming when the bond is offered to Sweet, it has a remaining life of 4 years.

Sweet required rate of return for her bond investment is 18% p.a.:

a. Compute for the value of each bond? How much is the total value of the bonds

offered?

b. Based on the offered price, what is the bond approximate and exact yield to

maturity?

c. Would you recommend to Sweet to buy the bonds? Why?

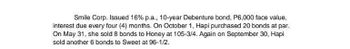

Transcribed Image Text:Smile Corp. Issued 16% p.a., 10-year Debenture bond, P6,000 face value,

interest due every four (4) months. On October 1, Hapi purchased 20 bonds at par.

On May 31, she sold 8 bonds to Honey at 105-3/4. Again on September 30, Hapi

sold another 6 bonds to Sweet at 96-1/2.

Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College