a zero bond is bond sold now at a discount and it will pay it's vace value at the time it matures, no interest payments are made. A zero bond can be redemmed on 20 yeard for $10,000. How much should you be willing to pay for it now if you want a return of 11% compounded quarterly 11% compounded continuously

a zero bond is bond sold now at a discount and it will pay it's vace value at the time it matures, no interest payments are made. A zero bond can be redemmed on 20 yeard for $10,000. How much should you be willing to pay for it now if you want a return of

11% compounded quarterly

11% compounded continuously

Face Value of the Bond = F = $10,000

Return

a. r = 11% compounded quarterly;

b. r=11% compounded continuously

No. of Years = t= 20 years

To calculate the present value of the bond

A zero coupon bond is a bond that pays the face value at maturity and is sold for a present value at a discount to the face value.

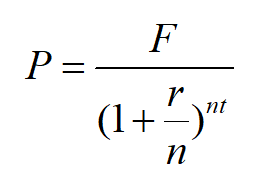

The formula for Present value of a Zero Coupon Bond is as follows:

a.

where,

F=face value

P=Present value

n=no. of compounding per year

t=no. of years

r=rate of interest

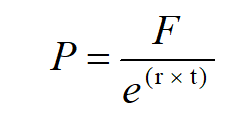

b. In case of a bond with continuous compounding, the formula is as follows:

where,

e is the mathematical constant with approximated value as 2.7183

Step by step

Solved in 3 steps with 4 images