A high growth company raised $10,000,000.00 in capital from a venture capital firm in the early growth stage of funding. The pre-money valuation of the company at the time the capital was raised $20,000,000.00. The terms of the investment also had an annual dividend of 8% and an exit preference of 1.2X upon a liquidity event. Based on these facts please answer the following questions. Presuming the company sells for $100,000,000.00 but also has $10,000,000.00 of debt on the balance sheet, what will the owners receive in proceeds?

A high growth company raised $10,000,000.00 in capital from a venture capital firm in the early growth stage of funding. The pre-money valuation of the company at the time the capital was raised $20,000,000.00. The terms of the investment also had an annual dividend of 8% and an exit preference of 1.2X upon a liquidity event. Based on these facts please answer the following questions.

-

- Presuming the company sells for $100,000,000.00 but also has $10,000,000.00 of debt on the

balance sheet , what will the owners receive in proceeds?

- Presuming the company sells for $100,000,000.00 but also has $10,000,000.00 of debt on the

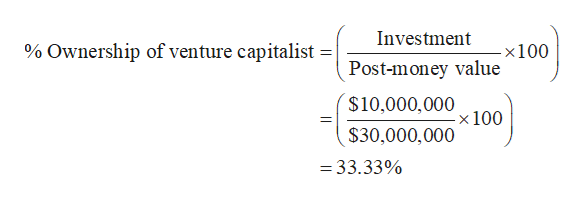

The percentage ownership of the venture capitalist is the proportion of its investment in the total value of the company’s capital. The investment made by the venture capitalist is $10,000,000 and the post-money value of the company is $30,000,000 ($20,000,000+$10,000,000). Therefore, the % ownership of the venture capitalist is 33.33%.

Step by step

Solved in 2 steps with 2 images