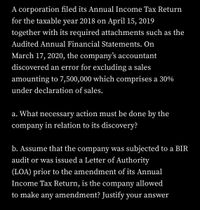

A corporation filed its Annual Income Tax Return for the taxable year 2018 on April 15, 2019 together with its required attachments such as the Audited Annual Financial Statements. On March 17, 2020, the company's accountant discovered an error for excluding a sales amounting to 7,500,000 which comprises a 30% under declaration of sales. a. What necessary action must be done by the company in relation to its discovery? b. Assume that the company was subjected to a BIR audit or was issued a Letter of Authority (LOA) prior to the amendment of its Annual Income Tax Return, is the company allowed to make any amendment? Justify your answer

A corporation filed its Annual Income Tax Return for the taxable year 2018 on April 15, 2019 together with its required attachments such as the Audited Annual Financial Statements. On March 17, 2020, the company's accountant discovered an error for excluding a sales amounting to 7,500,000 which comprises a 30% under declaration of sales. a. What necessary action must be done by the company in relation to its discovery? b. Assume that the company was subjected to a BIR audit or was issued a Letter of Authority (LOA) prior to the amendment of its Annual Income Tax Return, is the company allowed to make any amendment? Justify your answer

Oh no! Our experts couldn't answer your question.

Don't worry! We won't leave you hanging. Plus, we're giving you back one question for the inconvenience.

Submit your question and receive a step-by-step explanation from our experts in as fast as 30 minutes.

You have no more questions left.

Message from our expert:

Hi and thanks for your question! Unfortunately we cannot answer this particular question due to its complexity.

We've credited a question back to your account. Apologies for the inconvenience.

Your Question:

Transcribed Image Text:A corporation filed its Annual Income Tax Return

for the taxable year 2018 on April 15, 2019

together with its required attachments such as the

Audited Annual Financial Statements. On

March 17, 2020, the company's accountant

discovered an error for excluding a sales

amounting to 7,500,000 which comprises a 30%

under declaration of sales.

a. What necessary action must be done by the

company in relation to its discovery?

b. Assume that the company was subjected to a BIR

audit or was issued a Letter of Authority

(LOA) prior to the amendment of its Annual

Income Tax Return, is the company allowed

to make any amendment? Justify your answer

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis…

Accounting

ISBN:

9780134475585

Author:

Srikant M. Datar, Madhav V. Rajan

Publisher:

PEARSON

Intermediate Accounting

Accounting

ISBN:

9781259722660

Author:

J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:

McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:

9781259726705

Author:

John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:

McGraw-Hill Education