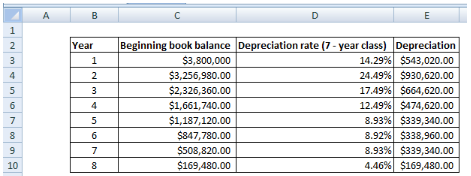

A company purchased a new forging machine to manufacture disks for airplane turbine engines. The new press cost $3,800,000, and it falls into the seven-year MACRS property class. The company has to pay property taxes to the local township for ownership of this forging machine at a rate of 1.2% on the beginning book value of each year.(a) Determine the book value of the asset at the beginning of each tax year.(b) Determine the amount of property taxes over the machine's depreciable life.

A company purchased a new forging machine to manufacture disks for airplane turbine engines. The new press cost $3,800,000, and it falls into the seven-year MACRS property class. The company has to pay property taxes to the local township for ownership of this forging machine at a rate of 1.2% on the beginning book value of each year.

(a) Determine the book value of the asset at the beginning of each tax year.

(b) Determine the amount of property taxes over the machine's

Modified Accelerated Cost Recovery System (MACRS):

MACRS is a current tax depreciation system that does not reflect the use of the asset certainly. The MACRS schedule will begin with the double-declining-balance method and then switches over to the straight-line method while finishing the schedule for most of the property. Other methods are not used for the taxation purposes generally.

(a)

Determine the book value of the asset at the beginning of each tax year.

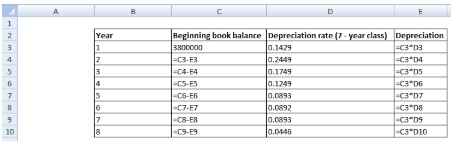

Workings:

Step by step

Solved in 3 steps with 3 images