A company needs a 33 tonnage refrigeration system. Knowing that a 20 tonnage similar refrigeration system only cost $100,000 15 years ago when the approximate cost index was 150, and that the cost index now is 370. The cost-capacity factor for a refrigeration system is 0.53. 1) estimate the required cost for the 33 tonnage refrigeration system in current year. 2) If borrowing the amount of required money is from a bank in current year and the bank interested rate is 6% per year, find the equivalent value (FW) as a single payment payed back to the bank in 15 years.

A company needs a 33 tonnage refrigeration system. Knowing that a 20 tonnage similar refrigeration system only cost $100,000 15 years ago when the approximate cost index was 150, and that the cost index now is 370. The cost-capacity factor for a refrigeration system is 0.53. 1) estimate the required cost for the 33 tonnage refrigeration system in current year. 2) If borrowing the amount of required money is from a bank in current year and the bank interested rate is 6% per year, find the equivalent value (FW) as a single payment payed back to the bank in 15 years.

1)

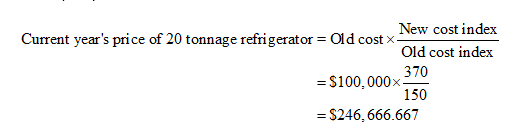

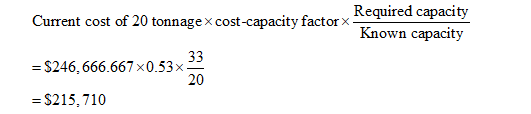

Needed capacity = 33 tonnage

Known reference capacity = 20 tonnage

Cost 15 years ago = $100,000

Old cost index = 150

New Cost index = 370

Cost capacity factor = 0.53

Now, the required cost of 33 tonnages in the current year

Step by step

Solved in 2 steps with 3 images